insight

The Case for REITs in an Insurance Portfolio

October 1, 2013

AAM has established an overweight to REIT (Real Estate Investment Trust) debt over the past three years. This position reflects the firm’s view that the sector offers attractive excess return potential due to good fundamentals and technical support. This paper will review the structure of the industry and the key credit factors that underpin our investments in the REIT sector.

REIT Investment Thesis

Investment in REIT corporate bonds provides exposure to the asset based cash flow generated by ownership of commercial real estate. In contrast to investment in Commercial Mortgage Backed Securities (CMBS), the underlying asset portfolios are dynamic, rather than static, and benefit from an experienced management team that manages the real estate holdings through the cycle. This exposure to commercial real estate will benefit from our expectation of continued slow but steady economic growth which will support operating fundamentals and underpin property valuations. At the same time, REIT balance sheets are significantly better positioned today than five years ago, and we expect this fundamental strength to endure over the intermediate term. Although the legal structure of the REIT sector makes it heavily dependent on capital market access, the experience of the global financial crisis demonstrated the sector’s resilience and the covenant protections unique to the sector.

Relative Value

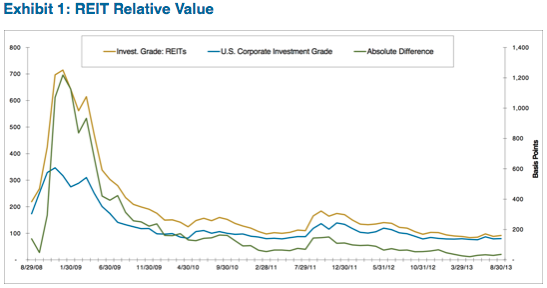

The REIT sector has exhibited a higher beta relative to the overall corporate index during times of volatility (Exhibit 1), and the sector trades wide of the broad corporate index. After reaching historic wides during the latter stages of the financial crisis in early 2009, REIT spreads compressed meaningfully as credit fundamentals improved. Going forward, the scope for REIT bond spread tightening appears modest given our macro forecast of restrained economic growth, but because the sector trades wide to the overall corporate index, our investments should continue to generate excess return via carry.

Sector Background and History

A REIT is a tax advantaged form of corporate organization focused on commercial real estate ownership. Created by Congress in order to encourage real estate investment, REIT designation requires that no less than 75% of operating income is generated from ownership/operation of real estate holdings, and that at least 90% of net income is paid out as common dividends to the REIT’s equity investors. The benefit of the REIT designation is that income is not subject to federal income tax so long as 90% is paid out to investors (thus avoiding the double taxation which traditional corporate equity investors face).

REITs invest across the traditional real estate subsectors (retail, multifamily, office) and increasingly have expanded into new subsectors (medical office, assisted living, industrial) and less traditional “real estate” sectors (timber land, billboards, cellular towers) over the past decade. Although REITs gained acceptance by institutional investor acceptance with the advent of publicly floated REITs in the early 1990s, the sector remains something of a niche product. While the liquidity provided by access to the capital markets have allowed public REITs considerably greater financial flexibility and scale than private real estate ownership, REITs still account for less than 15% of total commercial real estate ownership in the United States.

REIT debt has been included as a corporate subsector in the Barclays Capital Aggregate since 1997 and has risen from 0.72% of the outstanding corporate bonds in the Aggregate that year to 1.5% in 2003 and 2.25% as of August 2013. While REITs originally relied heavily on commercial mortgage debt provided by banks, the use of unsecured corporate debt and CMBS funding grew rapidly in the early 2000s, leading to a build-up of balance sheet leverage heading into the global financial crisis.

Following the collapse of Lehman Brothers, REITs were effectively shut out of the capital markets. This was a potentially existential threat for the sector, as the inability to retain earnings mandated continual access to capital in order to roll maturing debt. Public REITs addressed the funding challenge by returning to the banks for secured funding, and, beginning in early 2009, engaged in a sector-wide recapitalization. The REITs were able to accomplish such a recapitalization due to the existence of a dedicated REIT investor base (i.e., asset managers exclusively focused on REITs) which account for approximately 40% of total REIT equity holders. This group of investors was willing to participate both because of their single sector focus, and because they wanted to avoid the nearly 50% dilution to their existing holdings that such a recapitalization entailed. The success of the 2009 recapitalization laid the foundation for the recovery of the sector’s fundamental creditworthiness since 2010.

Recovery of Fundamentals Post 2009

As the U.S. economy emerged from recession in the latter half of 2009, the recapitalized REIT sector was well positioned for the dual recoveries in commercial real estate and the capital markets. The low interest rate environment and modest economic growth supported a recovery in commercial real estate valuations, allowing REITs to exit non-core portions of their portfolio at a gain. At the same time, the low cost of funding and demand for corporate debt by fixed income investors provided the financing for opportunistic acquisition. Public REITs were at a particular advantage relative to non-public real estate owner/investors who were still cut off from the capital markets and carrying properties at a loss. This combination of factors allowed the large, well capitalized public REITs to cherry pick the best of the large amounts of commercial properties that had ended up in special servicing or outright default during the recession.

During the depths of the recession, most public REITs experienced deterioration in credit metrics as operating results came under pressure. Most made a concerted effort to preserve occupancy to the extent possible by offering rent and lease term concessions in order to renew expiring leases. With the renewal of economic growth, and the rationalization of REIT portfolios, occupancy has recovered rapidly, and now stands at or above pre-recession levels for most subsectors.

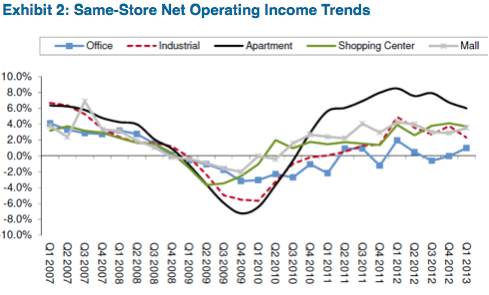

At the same time, net operating income (NOI), which fell rapidly due to lease concessions offered during the down turn, also recovered (Exhibit 2). Albeit, at a slower pace than occupancy, given the extended concessions granted in order to maintain occupancy. However, NOI has continued to grow even as occupancy has stabilized, as lack of new development has allowed REITs to push rent increases and previous lease concessions have expired.

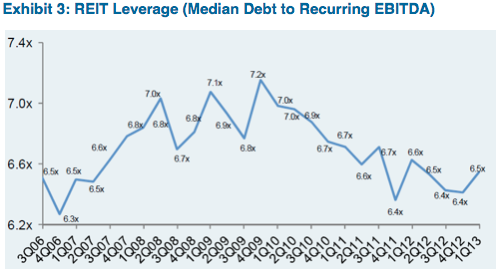

The combination of improving operating results and renewed access to the capital markets have combined to drive balance sheet deleveraging and improving credit metrics (Exhibit 3). Following 2009, all of the REITs have aggressively reduced leverage on their balance sheets, both through debt refinancing and improved profitability. In addition to reducing balance sheet leverage, REITs have taken advantage of the low rates to term out funding and to pay down secured mortgages using unsecured bonds.

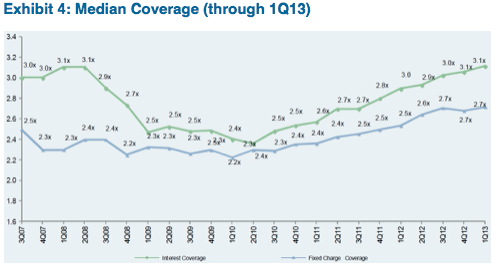

REITs have also taken steps to improve liquidity following the crunch experienced in 2008. As noted previously, they have meaningfully termed out their debt, taking advantage of the low rates and receptive markets. Backstop credit facilities have been upsized and extended at lower cost. The result has been an improvement in distance to funding and meaningful improvement in fixed charge coverage ratios (Exhibit 4).

Credit Factors Sustaining REIT Bond Performance Going Forward

The strong performance of the sector over the past three years raises the question of whether the excess returns are sustainable going forward. We remain confident in our overweight to the sector, based on a number of fundamental and technical supports.

Balance Sheet Discipline – the lessons learned during the 2008 credit crunch appear to have stuck. REIT management teams have shown good discipline maintaining lower leverage and unencumbered portfolios despite falling cap rates, even in the face of increased competition for properties as financial buyers have re-entered the market. To the extent that balance sheet leverage begins to move back up, we would be forced to reconsider this point.

Lack of Development/New Build – while commercial real estate fundamentals have recovered substantially, development activity (and especially speculative development) remains very subdued, and new deliveries into key markets as a proportion of overall supply remain well below the peaks seen in late 2006. Partially this reflects still tight credit from banks that are running off legacy construction lending portfolios. As well, much of the commercial development infrastructure remains deeply impaired five years after the crisis. Although there has been some resumption in multifamily development in the strongest coastal markets (NYC, Northern California, Seattle), deliveries into these markets are generally less than one percent of outstanding supply annually, and has been outstripped by demand as these markets have enjoyed the strongest recovery in employment.

REIT Covenant Package – Unique within the investment grade bond space, REITs have traditionally included a financial covenant package that caps leverage and secured debt, imposes interest coverage tests and require maintenance of unencumbered assets-to-debt. Over the past five years, inclusion of the “standard REIT covenant package” in new debt has become virtually universal, and the protections have become even more explicit (e.g., Joint venture carve-outs have become standard). These covenants protect bondholders by maintaining balance sheet flexibility going into a crisis, and give creditors more leverage with management (something not enjoyed by the rest of the investment grade bond market). Furthermore, these covenants effectively prevent leveraged buy-outs in the REIT space.

Excess Spread Has Technical Support – Despite the growth of REIT debt outstanding, it remains a very small sector at 2.25% of the Barclays Capital Corporate Index. This small size, as well as the reluctance of parts of the investment grade bond investor base to participate in the sector due to its relative newness and niche asset class reputation, have resulted in the sector trading wide to the overall corporate index, and to similarly rated sectors. The small issue size and less frequent issuance for the sector also tend to discourage total return investors that might otherwise invest actively and cause a normalization of spreads. Because of these technical factors, we believe the relative OAS advantage of the sector is likely to sustain, providing a carry benefit, even if there is not further tightening in the basis between the REIT sector and the broader Corporate Aggregate.

Macro Outlook is Supportive – The REIT sector is one of the higher beta sectors within the investment grade corporate bond universe. However, AAM’s expectation is that the modest economic recovery that has been under way for the past four years will continue at least for the next two years, with the active support of the Federal Reserve. In the context of 2-3% GDP growth, we expect that class A commercial real estate in the strongest markets should continue to perform. While we have begun to see a pick-up in M&A within the sector, we believe that bondholders are protected by the covenant package, which assures prudent financing with a high proportion of equity funding (which has in fact been the case in the two largest transactions over the past year).

REIT Subsectors Favored by AAM

Multifamily – This sector has been supported by the resumption of employment growth in the markets experiencing the strongest economic recovery (coastal markets and Texas) as well as the fall in home ownership. Operators that have been very focused on their core markets (such as Essex (ESS) in California or Camden (CPT) in Texas) have benefited from a strong rebound in both occupancy and rental rates. Despite an increase in new build activity, supply is well below emerging demand.

Central Business District (CBD) Office – Class A property has rebounded strongly, especially in Boston and San Francisco where performance has been bolstered by technology and biotech demand. While New York has been impacted by downsizing in the financial sector, the best operators have been actively reformatting large space for smaller financial services firms (hedge funds), while exiting aging properties and taking advantage of capital markets access to finance the purchase of new Class A properties. While there has been a resumption of CBD construction, it is generally pre-leased with anchor tenants. In contrast, suburban office properties continue to struggle with high vacancies and ease of replacement by tenants. In this sector we favor Boston Properties (BXP) while avoiding suburban operators.

Retail – The two largest regional mall operators (Simon and Westfield) have widened their advantage over competitors during the recovery, focusing on the higher end malls (and the former has moved aggressively into premium outlet shopping). We have also invested in the two largest triple net lease (lessees responsible for maintenance/taxes/insurance) operators which focus on single location leases with long durations and strong underlying real estate characteristics (National Retail (NNN) and Realty Income (O)). In contrast we have avoided most community shopping centers and strip center operators which have been plagued by high vacancies in small shop space and a shake out in the casual dining sector.

Risks to the Sector

While we have a high degree of confidence in our REIT sector investment thesis, there are several key risks that bear consideration.

Capital Market Dependence – Because REITs cannot retain earnings (dividend requirement), they are dependent on capital markets both to grow (through new equity issuance) and to refinance outstanding debt. As noted previously, we expect the balance sheet discipline of the past several years to sustain over the intermediate term, and all of the REITs we invest in have substantial liquidity. However, the wholesale funding risk is fundamental to the sector and investors should be compensated for this risk.

Rising Interest Rates – While rising rates will impact both real estate valuations and cost of funding, REITs have meaningfully termed out their debt funding at historically low rates. Furthermore, the spread between current cap rates and REIT funding costs remain at historic wides, and thus would be able to sustain a reasonable amount of compression.

Tax Reform and REIT Status – While the prospect of comprehensive Federal tax reform appears slim, REIT status is ultimately a tax preference and could come under consideration as part of broader reform in the future. Also, as more new property types file for REIT designation, the sector could draw unwelcome attention from tax reform advocates (examples of this include a recent unfavorable article in the New York Times regarding private prisons potentially filing for REIT status).

Conclusion

In conclusion, our overweight to the REIT sector reflects slow but steady macroeconomic improvement to the US economy, prudent balance sheet management, and sustainable operating results. We believe that investors are compensated for the higher volatility of this sector vs. the broader Corporate Index, and believe that our investments in REIT corporate bonds will continue to generate positive excess returns for our clients.

N. Sebastian Bacchus, CFA

Senior Analyst, Corporate Credit

For more information, contact:

Colin T. Dowdall, CFA

Director of Marketing and Business Development

colin.dowdall@aamcompany.com

John Olvany

Vice President of Business Development

john.olvany@aamcompany.com

Neelm Hameer

Vice President of Business Development

neelm.hameer@aamcompany.com

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.