At AAM we are often asked about our thoughts on U.S. Treasury Inflation Protected Securities (TIPS) and if we recommend them for client portfolios. In 2022 that question is especially relevant as inflation hits highs not seen in four decades. It is our opinion that TIPS at times do have a place in client portfolios but there are better alternatives that provide higher income and cushion the portfolio against rising interest rates caused by inflation. This paper is going to review TIPS and how they work, how TIPS have performed in the current high inflation environment and some alternative strategies in this high inflation environment.

Treasury Inflation Protected Securities (TIPS) are securities issued by the U.S. Treasury that have features that are intended to protect investors from inflation. Like regular Treasury Bonds, TIPS are issued at auction and have a fixed coupon and maturity. Where TIPS differ from regular Treasury Bonds is after issuance the TIPS’s principal value is adjusted daily based on an index tied on the Consumer Price Index (CPI). If CPI is positive the principal of TIPS goes up and if there is a deflationary environment where CPI is negative, the principal of the security is adjusted downward. The security protects the investor against inflation by paying more interest in an inflationary environment, the fixed coupon is being paid on a higher principal amount. This feature also factors into the valuation of the security as the yield on the security is typically lower than a standard Treasury security as the market factors in the expectation of future inflation into the price of the securities. This is why the TIPS yields are referenced as real interest rates because it is supposed to strip out the expected levels of future inflation. The difference between the TIPS yield and a regular Treasury yield of the same maturity is referred to as the break-even rate. If inflation over the period of holding TIPS is the same as the break-even rate, then the regular Treasury security and the TIPS will earn the same income over the period. This is why the break-even rates on the TIPS yield curve and the Treasury yield curve is referenced as the market’s expectation of future inflation.

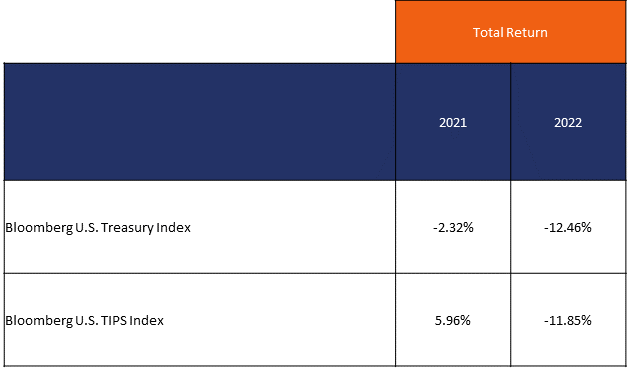

TIPS have limited issuance and are thinly traded. Even when the Federal Reserve is not involved in the market, TIPS have been volatile relative to fixed rate Treasury Securities. When the Federal Reserve starts trading TIPS under a quantitative easing (tightening) mandate, they become even more volatile. A good example of this is if you look at the performance of the TIPS vs. U.S. Treasury indices in 2021 and 2022. During 2021 inflation was accelerating coming out of the pandemic which caused TIPS to perform well vs. Treasury securities. Additionally, the Fed was also purchasing TIPS at a rate that caused negative net supply in the sector. All of these factors caused the Bloomberg TIPS Index to outperform Bloomberg Treasury Index by 8.28% in 2021. As the Fed pivoted in 2022 to fighting inflation they began tightening monetary policy by ending their asset purchases, letting their balance sheet shrink, and raising rates aggressively. This put price pressure on the sector as the biggest buyer of the sector stepped away from market. All of these dynamics have caused TIPS to return similarly to regular Treasury securities in 2022 despite having the highest inflation in 4 decades.

AAM does not believe client portfolios should have a core allocation to TIPS as a hedge for inflation, but AAM does invest in the sector occasionally as a tactical strategy vs. regular Treasury securities. Since the TIPS market is thinly traded, there are times when break-even rates get distorted and TIPS are compelling as a short term total return trade vs. regular Treasury securities. There can be technical pressures that cause TIP break-even rates to fall below AAM’s view of future inflation. As breakeven rates normalize, TIPS will outperform Treasuries as the difference between nominal and TIP yields increase and cause nominal Treasury prices to decrease relative to TIPS.

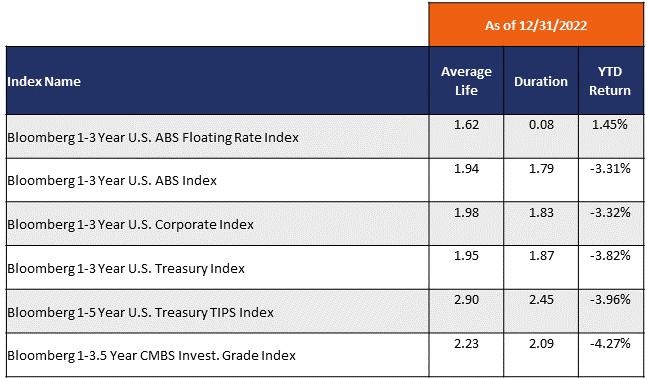

AAM feels a better way to hedge against inflation is to invest in floating rate securities. Typically, in high inflation environments, the Federal Reserve will be tightening their monetary policy and raising The Fed Funds rate to try to tamp down demand and cool prices. Collateralized Loan Obligations (CLOs) and floating rate securities in sectors like ABS and Corporate Bonds typically perform better in these environments. These floating rate securities have coupons that reset monthly or quarterly that tie to a reference rate such as Libor or SOFR. This is important because as the Fed raises interest rates, these reference rates move higher which in turn moves the coupon higher. This minimizes the price sensitivity to rising interest rates and in turn helps hedge against inflation. In 2021, AAM began increasing allocations to AAA rated CLOs and these types of securities in client portfolios as a hedge against future inflation. In 2022 when interest rates rose sharply, you can see the impact of the resetting coupons in the total return of floating rate ABS rate index vs. similar maturity short duration securities in other sectors:

In conclusion, AAM does not view TIPS as a core allocation in client portfolios because they are a low yielding, thinly traded sector that doesn’t effectively hedge inflation risk. An allocation to floating rate securities can provide more income and less sensitivity to rising rates that accompany high inflation.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.