insight

Turning Interest Rate Losses into Book Yield Gains: Capitalizing on the Interest Maintenance Reserve

November 8, 2022

Download PDFInterest Maintenance Reserve: Smoothing Interest Rate Impact on Life Insurance Balance Sheets

To support long-term commitments to insureds, life insurance companies invest in long-duration bonds. Changing market dynamics and liability attributes can lead life insurers to sell long-term investments, realizing sizable gains and losses in the process. To accommodate these sales, the NAIC established the Interest Maintenance Reserve (IMR). The purpose of the IMR is to reduce “the effect that realized gains and losses attributable to interest rate movement have on current year operations.”1 This is achieved via a liability account that aggregates after-tax gains and losses on eligible dispositions that occur in the absence of a credit loss. These gains and losses are amortized into earnings over the remaining expected life of the assets sold, which can result in greater stability of life insurer income and surplus over time.

Through the IMR, the NAIC created a pathway for life insurance companies to increase economic value through active investment portfolio management. While dramatic interest rate increases have reduced long-duration bond prices, a healthy IMR offers insurers an opportunity to grow economic value and book yield. In this paper we will look back at the circumstances that have driven growth in IMR balances, and discuss the yield enhancement opportunity available to active managers in the current rate environment.

Low Investment Yields: Active Management Contributed to Statutory Book Yield Decline

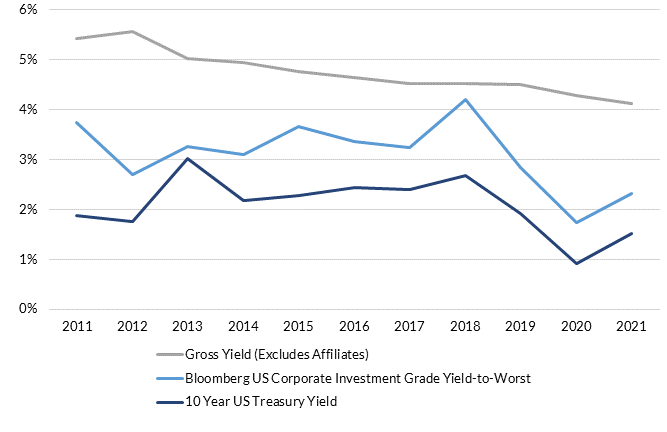

The life insurance industry endured a decade beset by low investment yields across capital market segments. For much of this period the 10-year US Treasury note yielded below 2%, resulting in significant changes to life insurance product terms over time. According to S&P Capital IQ, the gross book yield on bonds for US life insurers declined from 5.4% in 2011 to 4.1% in 2021.2

Exhibit 1: Life Industry Gross Bond Yield vs US Corp IG Market Yield

Low investment yields earned on new premium revenues were a key contributor to this decline. However, companies with an active approach to managing investments faced even greater declines in book yield, as realization of gains on higher-book-yield bonds pushed income into future periods via the IMR. Over the past decade the industry’s total IMR reserve nearly doubled to a 12/31/2021 balance of $39.3 billion, even after netting out the $33 billion amortized into industry earnings over the period.3 Unfortunately, as a result of IMR amortization of gains and losses, income benefits from trade activity that enhance portfolio market yield may be distorted or deferred in statutory earnings and cash flow testing.

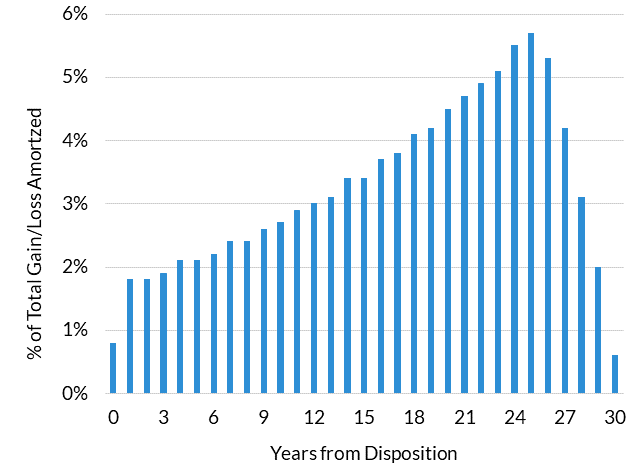

The IMR uses the Weighted Average Life Remaining (WAL) of disposed assets to determine the amortization schedule of realized gains/losses. Exhibit 2 illustrates the annual IMR amortization percentages for a gain or loss realized from selling a 30-year WAL asset:

Exhibit 2: IMR Gain/Loss Amortization With 30-Year Weighted Average Life Remaining

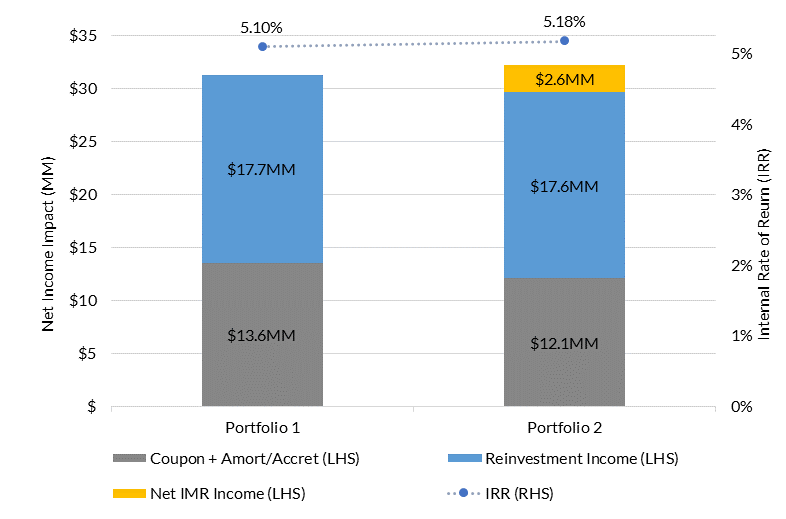

A clearer picture of the impact of IMR can be illustrated by examining a representative transaction involving a sale and reinvestment of proceeds where a significant gain was realized to add market yield.4 The example starts with a single-bond portfolio in 2019. In Portfolio 1, the bond is held to maturity with principal and interest cashflows being reinvested through 2049. Portfolio 2 liquidates the original bond in 2019, generating a gain, and purchases an alternative bond to improve the market yield on sale proceeds.

While the sale decreased portfolio book yield, the transaction was ultimately additive to investment income when IMR amortization and reinvestment yield are accounted for. In Exhibit 3, we illustrate the relationship between the book yield reduction, the IMR gain captured, and the increase in market yield on reinvested proceeds to calculate the cumulative impact on statutory investment income. As the graph indicates, assuming a consistent reinvestment rate on cash flow, reinvestment in an asset with an increase in market yield produces a substantial cumulative benefit over a matched 30-year horizon.5

Exhibit 3: Economic Benefit of Market Yield Pickup

Realizing gains in a bond swap does not guarantee an increase to cumulative income. The trade requires analyzing changes to the book and market yield relationship and reinvestment risks since acquisition of original assets. These opportunities were frequent in the past decade, resulting in realized gains, dampening book yields, and significant IMR balances for life companies employing active management. While lowering book yield, the above trade could be replicated multiple times within a portfolio, benefiting income and surplus so long as cash flow adequacy is maintained.

Realized Gains Have Cash Flow Testing Consequences for Interest-Sensitive Life Insurers

Annual regulatory testing of life insurer balance sheets measures the adequacy of assets in supporting policy commitments. If assets are properly aligned with liabilities, profitability from investment portfolio income and IMR amortization can be easily measured relative to liability costs. The analysis is more complex with interest-sensitive liabilities, which are difficult to immunize across a variety of rate scenarios. We have observed cash flow testing output in which low-book-yield bond portfolios underperform higher-book-yield bond portfolios at supporting interest-sensitive policies. In certain rising-rate scenarios, models fund policy surrenders with asset sales that produce realized losses on low-book-yield bonds. With enough sales at losses, the accumulated IMR balance can be depleted, resulting in surplus destruction in the model output. It is important to acknowledge the necessity of book yield sufficiency and the benefits of unrealized market value gains for interest-sensitive life insurance blocks within annual asset adequacy/cash flow testing models.

Capitalizing on Accumulated IMR Balances to Increase Book Yield and Economic Value

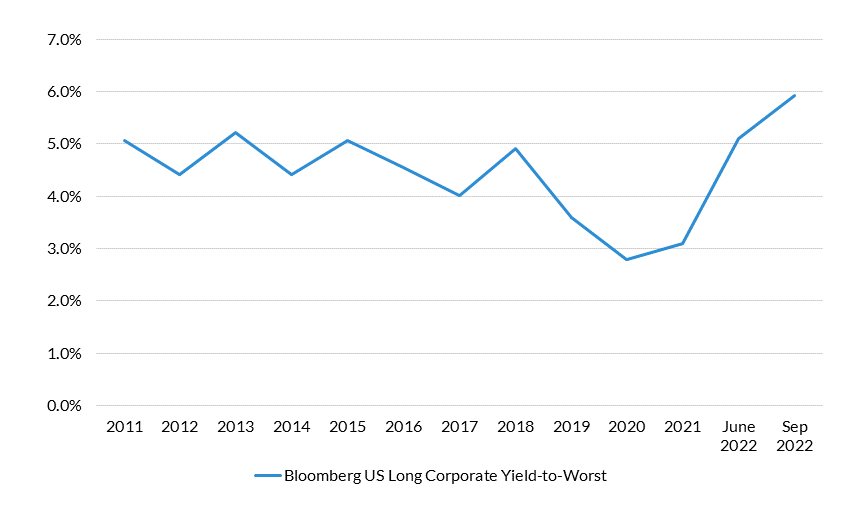

2022 has brought a dramatic increase in new money rates across fixed income sectors, providing life insurance companies with the best new money yield opportunities in more than a decade. For assets purchased in the preceding decade, though, rising rates have resulted in significant interest rate-driven unrealized losses.6

Exhibit 4: Long US Corporate Aggregate Market Yields

With unrealized losses prevalent, life insurers and their investment advisors must be disciplined with transaction activity and well versed in statutory treatment of interest-rate-related losses to ensure that their full effects on income and surplus are understood. While some investors may seek to avoid realizing losses past a certain threshold or altogether, life insurers can sell low book yield items and use accumulated IMR balances to offset realized losses driven by recent interest rate increases. Today’s higher yields are providing an opportunity to enhance portfolio book yield and illustrate the benefits of through-cycle active management.

Following the same logic as the trade in Portfolio 2 above, let’s now assess the impact of a representative sale and reinvestment of proceeds, where the insurer realizes a capital loss.

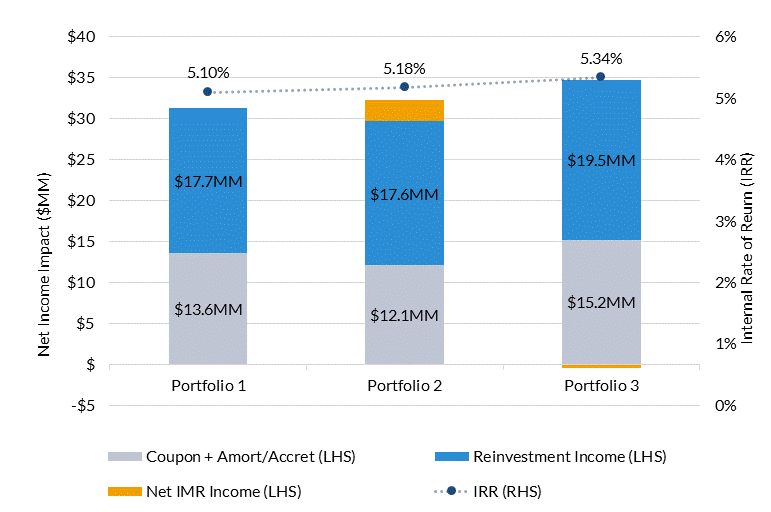

Market yield and reinvestment rates will again determine the amount of income earned on invested capital. Exhibit 5 illustrates this relationship, where a low book yield bond (Portfolio 2 from the prior example) is sold to fund a new investment opportunity with a similar quality and maturity at a higher market yield (Portfolio 3). Rising interest rates produce a realized loss on the sale of Portfolio 2 that is approximately equal and offsetting to the remaining IMR gain from the Portfolio 1 sale.7 Considering all components of book income, we calculate that the annualized Internal Rate of Return (IRR) on the original invested capital increases by an additional 16 basis points over the same 30-year horizon with this trade.8

Exhibit 5: Economic Benefit of Market Yield Pickup

IMR Loss Implications on Cash Flow Testing

In addition to the flexibility to pursue income enhancement afforded by accumulated IMR balances, IMR losses can improve cash flow testing output when sales are replaced with higher-yielding assets. This process values assets at their book value; a sale and reinvestment into a higher-yielding asset reduces the total unrealized loss at the start of the testing period, and thus reduces potential future realized losses across interest rate scenarios. For interest-sensitive life insurance products, this leads to improved results in rising rate environments.

Conclusion

With ultra-low reinvestment rates in the rearview mirror, active managers have an opportunity to out-earn traditional buy-and-hold strategies. Life insurers should consider prudent trade opportunities that enhance book income and benefit cash flow testing, using their accumulated Interest Maintenance Reserve to absorb realized capital losses. As the Barclays US Corporate Investment Grade Index yield surpassed 5.5% in September 2022, insurers should seek to capitalize on higher interest rates through reinvestment of runoff cash flows and opportunistic sales proceeds. By doing so, insurers can take advantage of today’s market dynamics to shift the IMR liability to the asset side of the balance sheet.

1 Source: National Association of Insurance Commissioners, Statutory Issue Paper Number 7: Asset Valuation Reserve and Interest Maintenance Reserve.

2 Source: Bloomberg LP, S&P Global Intelligence, statutory financial data through 12/31/2021.

3 Source: S&P Global Intelligence, statutory financial data through 12/31/2021.

4 Hypothetical sale using market pricing in 2019 where proceeds were invested in a 30-year new issue. Model accrues benefit to buy-and-hold strategy through reinvestment of cash flows at higher prevailing rates.

5 Example assumes reinvestment of cash flows at 3.25% in years 1 to 3 followed by 5.25% through terminal year 30

6 Transactions resulting in Portfolio 3 generate a net loss equal to 4.5% of beginning book value in year 0

7 Example assumes reinvestment of cash flows at 3.25% in years 1 to 3 followed by 5.25% through terminal year 30

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.