Summary

The upcoming G20 summit beginning June 28th is a critical date for the investment community. What will happen if there is no trade agreement between the United States and China? Will the Fed lower rates in anticipation of that outcome or if disappointing, in reaction to it? As written in our last quarterly Corporate Credit Review, the bond market seems to have taken a much more negative stance than the equity market on the economy. And, unlike the start of the year when most Wall Street firms had fairly similar outlooks for the year, now they differ on what the Federal Reserve will do and the outcome regarding tariffs on Chinese goods. This type of market provides opportunities. AAM believes the probability of reaching a deal has increased modestly after the quick resolution with Mexico, but that probability is more remote than is a hardened stance. That expectation leads us to take a more defensive position in risk assets, preferring less cyclical sectors and higher quality credits.

What happened to the deal the markets expected in April?

By May, the markets were pricing in a high likelihood of a deal with China in regards to tariffs. There are a multitude of reasons as to why progress was halted, including the possibility that the U.S. administration was employing a “hard-bargaining” negotiation strategy which meant the likelihood of an agreement was always lower than the market grew to believe. This may have been the strategy with Mexico, although that outcome was much easier to predict given the extreme downside risks.

We do not believe China can yield to the demands the U.S. is making as it would be politically unpalatable. The breakdown of talks occurred due in part to the U.S. administration’s insistence that Chinese curb subsidies to its state-owned enterprises in strategic sectors, like technology. China finds this unacceptable given its ‘Made in China 2025’ strategy. For China’s economy to continue to grow, its manufacturing has to evolve to higher value added products and services and manufacturing capabilities. The insistence by the U.S. administration that enforcement of the deal would come in the form of changes in China’s laws and oversight mechanisms not just through regulatory changes represented a direct challenge to China’s state control model laid out in the 2025 strategy. And, existing tariffs would not be lifted until enforcement of the trade deal was verified. Political stakes are high, and both leaders feel the need to remain strong in these negotiations.

Now what?

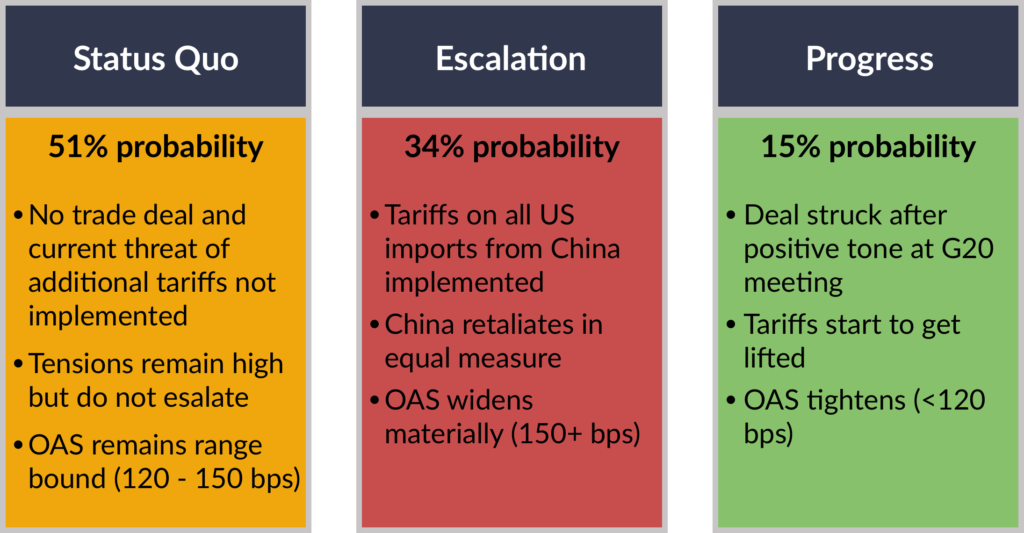

We look at possible outcomes through a three outcome framework:

1. The status quo remains for the duration of the year and most likely, until the next U.S. presidential election.

2. Tensions increase with both countries increasing tariffs and imposing other restrictive measures. The temporary general license issued by the U.S. government suspending the ban against selling equipment and software to Huawei is not extended.

3. Significant progress is made during the G20 summit followed by a trade deal that works to ends hostilities between the two countries and starts to lift at least some of the tariffs.

While direct costs seem to be relatively easy to calculate for the current level of tariffs and are relatively modest (e.g., less than 0.3 percentage points off U.S. and China’s growth respectively), the more difficult calculation is related to the uncertainty and loss of confidence by businesses and consumers. If the global economy is in fact oversupplied and is relying on credit growth to absorb this excess supply, a loss of confidence that impacts investment and spending would be particularly threatening to global and U.S. GDP. Therefore, despite tariffs being viewed as inflationary, the impact would over the longer term, be in fact deflationary. An escalation of the “trade war” would be very costly in the form of economic growth and financial costs, resulting in falling Treasury yields and equity markets. We would expect spreads to widen materially as the risk of recession increases. In particular, underperformance is expected from long duration, low BBB credits as well as cyclical and liquid sectors.

AAM believes the status quo is the most likely outcome in 2019, as the costs related to tariffs are less than the political fallout that would likely occur for US President Trump and China President Xi Jinping if either concedes. Our expectation for a trade deal at the G20 summit getting done or foreshadowed is quite low since getting tough on China is one of few bipartisan issues in the U.S., making it difficult for the current administration to soften its stance unless the risk of recession increases more materially. Moreover, given this stance, we believe it is more likely that threats escalate as China’s President Xi, who faces no term limits, is unable to bend to US demands without facing significant pressure from the Chinese Communist party. Therefore, we are assigning a material probability to that outcome.

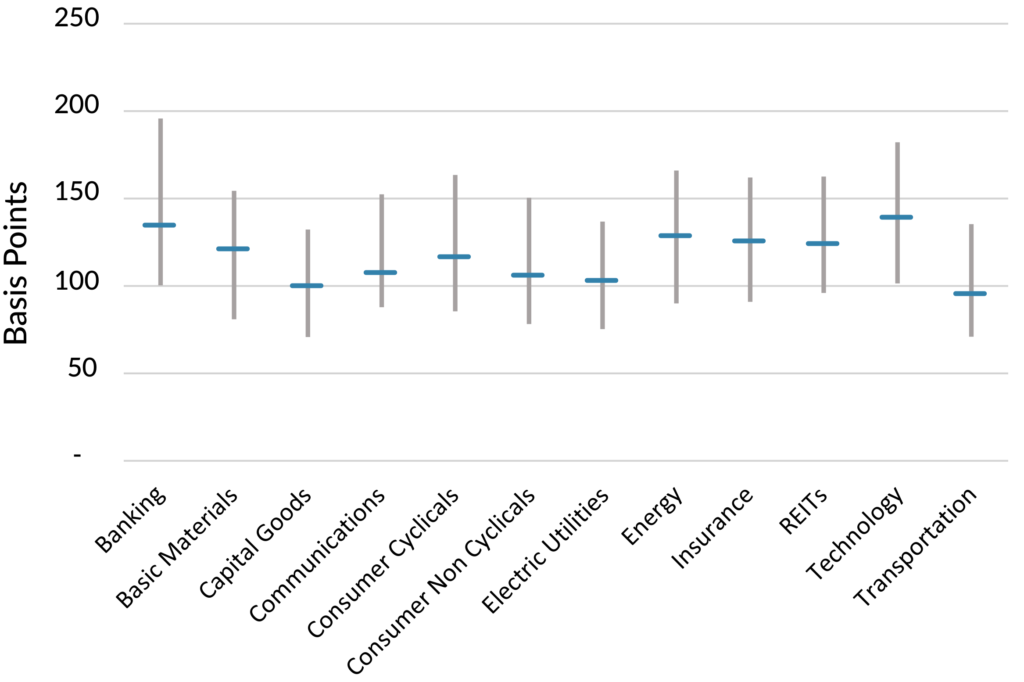

The G20 summit at the end of the month may change these probabilities materially. The candlestick chart shows the IG corporate credit spread volatility that has occurred over just the last two years. Current spreads largely in the mid-points of their trading ranges reflect the uncertainty that exists in the various trade outcomes we have outlined with the potential for near term volatility being quite high. With relatively little dispersion (~40 bps), we prefer more defensive sectors with stable cash flows and exposure to the U.S. economy. In regards to the more cyclical and liquid sectors, we have a more defensive position from a duration and/or credit risk perspective. The Banking sector in particular has been more resilient than we would have expected given falling rates and growth expectations. We view sectors such as Communications as providing less value today given the trajectory of growth, required investments (capital and operating) and lack of financial flexibility.

Current OAS vs. Min/Max Range

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.