insight

Universal Refinance Wave vs. Gradual HARP Changes

December 2, 2011

Agency Mortgage Backed Security prepayments have been a topic of concern for mortgage market investors. Will there be a universal mortgage rate, a refinance wave or gradual changes to existing mortgage programs? In this article, we will review the prepayment mechanics of the agency mortgage market that is insured by Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Association).

Over the past year, there have been a great number of rumors regarding a universal refinancing wave in the GSE (Government Sponsored Entities) agency mortgage market. We have witnessed a variety of national news stories regarding a government sponsored refinance wave and national media reports of a potential single thirty-year mortgage rate for every homeowner. These types of rumors have created many unpredictable days for the agency mortgage market and its investors. Despite the hearsay infiltrating the market, we do not believe that a universal refinance wave is likely.

In an effort to eliminate rumors and volatility in the market, the Federal Housing Finance Agency (FHFA) stated on October 24, 2011 that any new initiatives seeking to facilitate mortgage refinancing will be limited to the revamping of existing programs. Changes to the present refinancing plan, the Home Affordable Refinance Program (HARP), must be implemented in a manner that protects the taxpayers’ commitment to the GSE. The acting FHFA director, Edward DeMarco emphasized that while he was in favor of a program to aid homeowners, as the conservator of the GSE, he could only consider a plan that:

- Conserves the assets of the Government Sponsored Entities (GSEs)

- Preserves the liquidity and stability of the mortgage market and

- Helps homeowners while considering the costs to taxpayers

The HARP program was initiated on March 4, 2009. The program was put into practice to help current and responsible homeowners refinance at today’s lower mortgage rates, despite sharp decreases in home values. The government program was expected to help between 4 and 5 million homeowners when activated in April 2009. As of July 2011, however, only 20% of those homeowners were actually able to refinance. The program’s initial termination date was intended to be June 30, 2010 and has been extended three times now. The new termination date is December 31, 2013.

On Monday, November 15, 2011 the FHFA sent out a press release regarding the changes to the existing HARP program. Due to the mandates of the FHFA, those tweaks to the program did not create a massive refinancing wave. The changes are outlined below:

- Reducing risk based fees – Loan Level Pricing Adjustments (LLPAs)

- Elimination of the 125% LTV (loan to value) ceiling for fixed rate mortgage loans

- Adjustments to representations and warranties

- Streamline some property appraisals

- New program effective December 1, 2011

- HARP extension to December 31, 2013

The removal of Loan Level Pricing Adjustments will lower the cost of refinancing and encourage more borrowers to refinance. LLPAs were increased by both agencies in 2008 causing some of the recent difficulties in refinancing. LLPAs are special fees charged by the GSEs to guarantee any loan with a low credit score (FICO score), a higher LTV (loan to value) ratio or a feature deemed risky by the agencies (e.g., higher debt to income ratios, investor properties, second home, etc.). These fees generally range from 0.25% to 2%, but have been as high as 3%. There was a recent cap at 2% for certain loans that the agencies refinance from their own portfolio. Many times these fees were paid upfront or rolled into the total mortgage. When you look into the raw numbers of an extra 2% or a 3% fee ($8,340 or $12,510, respectively) on a $417,000 loan, it’s obvious why this could impede a homeowner to refinance. Reducing these LLPAs will increase prepayment mildly.

Another change is eliminating the 125% LTV cap and streamlining some property appraisals in certain qualified areas. Removing the LTV cap will help a small percentage of underwater homeowners (home is worth less than they paid) become eligible to refinance. An estimate of qualified HARP homeowners that hold an agency mortgage with an extremely high LTV is said to be about 1% to 2% of the agency mortgage universe. A small percentage of homes will not require appraisals but will be valued using a GSE’s housing model that will ease the refinancing process.

Changes to representations and warranties can be the most complicated HARP alteration. A change to “reps and warranties” essentially revisits underwriting flaws for lower creditworthy borrowers. It seemed to be a trend in the past that the insufficient mortgage underwriting was focused on the lower creditworthy and lower documentation type borrowers. Originators “supposedly” had confirmed property valuations, borrower’s incomes, assets, employment, etc. at origination. If the originator cannot prove the loan was adequately underwritten, the GSE can force the servicer to buy the loan back (called a “put back”) in a new mortgage default.

It seems that this “put back” capability by the GSE hindered certain loans from being refinanced by the mortgage originator. One main reason for this problem is if these loans did default within 12 months of a refinancing, the originators are responsible for the loss. The loss would be assumed to be 40 to 60 cents on the dollar for each mortgage when the loan is put back. The originators today are unwilling to rep and warrant many of the older “qualified” borrowers of years past because of this potential put back loss. This potential default on a less creditworthy borrower and fear by the mortgage originator has slowed the HARP refinance program. In general, the detailed changes were minimal on reps and warranties for Fannie Mae and a little more meaningful for Freddie Mac, who waived most reps and warrants.

To qualify for the program, the loan must be a first lien and owned or guaranteed by either agency. Loans that originated and sold into private label securitizations are ineligible for the HARP program. In addition, the mortgage must be current for Freddie Mac (no late payment within the last 12 months) and the qualifier can only have been 30+ days delinquent once in the last 12 months for a Fannie Mae loan. Based on Mortgage Bankers Association statistics, we have seen 30+ days delinquencies on mortgage payments reach as high a 10% nationally and now has dropped to the 8.5% area. These numbers alone eliminate more than 8% of the market from possible refinancing.

Recent Agency Mortgage Prepayment Speeds

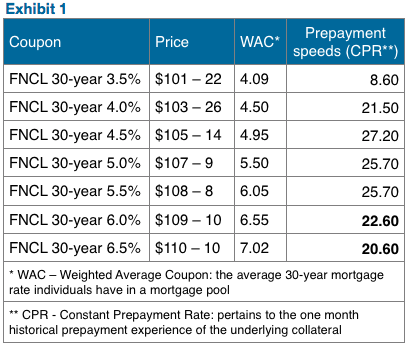

It’s interesting to compare historical prepayment speeds across different MBS to see exactly how speeds have changed from historic norms. The lack of credit available to lower FICO borrowers and the ineffectiveness of the original refinance program has prevented many homeowners with a 5.5% to 7% mortgage rate from refinancing. If you look at Exhibit 1 for the generic 30-year Fannie Mae guaranteed mortgages this month, you will notice that the higher coupon borrowers are prepaying more slowly relative to lower interest rate borrowers. Of note are the 6% through 6.5% coupons. These coupons are paying slower than 4.5% through 5.5% coupons. In past low interest rate environments, 30-year 6.5% coupons have paid between 55 and 93 Constant Prepayment Rate (CPR) depending on year of origination.

The FHFA estimates close to one million more homeowners will be eligible to refinance under the modified program. The new HARP program should not cause a massive refinance wave. You will see prepayments increase in speed from 3% to 12% to different degrees across a variety of Mortgage Backed Securities. The prepayment increases in 30-year agency Freddie Mac and Fannie Mae mortgages should not be substantial or shocking to the market. While speeds will increase in 2012, we believe current MBS prices have factored in this increase and the market is fairly valued. The HARP changes most likely will not be felt by the market until early 2012.

Christopher M. Priebe

Vice President, Mortgage Backed Securities Trader

To read the Fannie Mae and Freddie Mac November 15, 2011 announcements, click on the links below:

- https://www.fanniemae.com/mbs/announcements/2011/mbs_announcement_111511.jhtml?p=Mortgage-Backed+Securities

- https://www.freddiemac.com/sell/guide/bulletins/pdf/bll1122.pdf

For more information, contact:

Joel B. Cramer, CFA

Director of Sales and Marketing

joel.cramer@aamcompany.com

Greg Curran, CFA

Vice President, Business Development

greg.curran@aamcompany.com

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.