Are Investors Getting Paid for the Risk in the Corporate Bond Sector?

With credit spreads over US Treasuries (UST) for U.S. investment grade (IG) rated corporate bonds declining towards decade lows, we must step back and ask ourselves if we are getting paid to own them. Risk in this sector for investors is largely the volatility in spreads which affects bond prices, as losses on IG rated bonds is virtually nil1. When examining potential volatility and credit fundamentals, we generally find value today in short-to-intermediate maturities, Financials and Utilities. We expect that credit and sector selection will be an important driver of performance in 2024

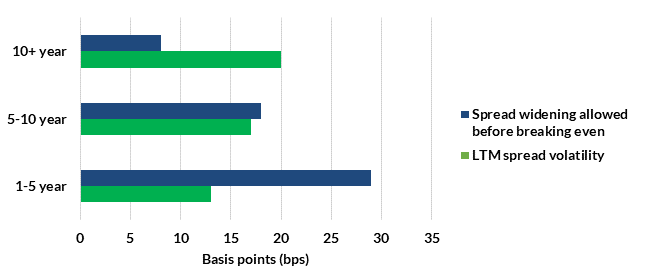

Working under the assumption that UST risk is hedged, thereby focusing only on the movement in credit spreads, one can measure relative value in multiple ways. One way is performing a breakeven analysis, which includes examining the minimum spread widening allowed to achieve an excess return of zero versus the volatility in spreads. Exhibit 1 shows that if the spread of the average 10+ year corporate bond widened more than 8 bps, that bond would generate a negative excess return vs. the UST. Since the volatility in spreads for long maturities has averaged 20 bps over the last twelve months, the risk appears elevated today. Conversely, the volatility for shorter maturities (1-5 years) has been 13 bps, which is well inside the 29 bps allowed for an investor to breakeven.

Exhibit 1: Shorter maturities have a higher breakeven point

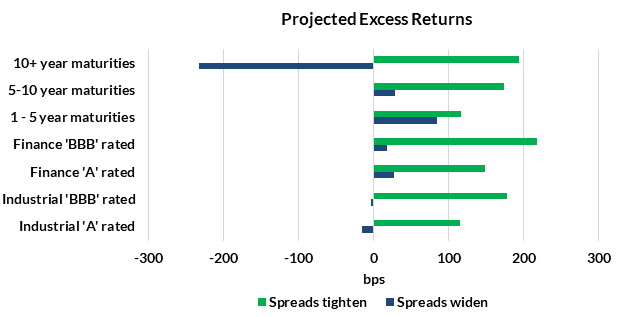

While this is an easy analysis to perform, assumptions are important when performing these calculations. Drivers for spreads last year are likely to be different this year. If one forecasts lower volatility in 2024 than what we have experienced in 2023 given the risk of recession was higher last year2, the output changes. In this scenario, projected excess returns are positive or only modestly negative except for long maturities given the level of spreads today. For instance, for 5-10 year maturities, projected excess returns over UST are 0.28% to 1.74% (i.e., both positive) if the spread today (108 bps) widened to 134 (last twelve month (LTM) mean) or tightened to 106 bps (LTM minimum) respectively.

Exhibit 2: A lower volatility assumption produces a more favorable view

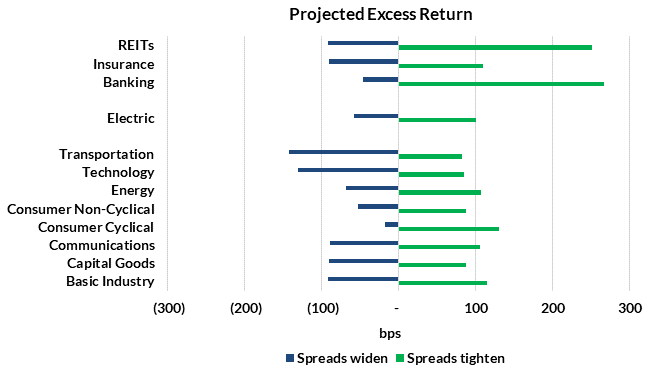

Finally, when analyzing various Corporate sectors using the framework in Exhibit 2, we see that financial and commodity-based sectors as well as utilities have more upside than downside projected (Exhibit 3). The spread ranges used in this analysis reflect technicals and fundamentals over the last twelve months. Therefore, to assign probabilities to these bear/bull cases or change the spread range, one must project differences in technical and/or fundamental drivers.

Exhibit 3: Return forecasts differ greatly at a sector level

At AAM, we have a team of experienced, sector-focused analysts and traders who measure risk, do their own analysis and assign credit ratings to companies instead of relying on credit rating agency ratings. Traders look for mis-priced opportunities where the market may be viewing a company more or less favorably than AAM’s analysts. After netting positive and negative differences, we view fundamental-driven spread widening risk as fairly balanced. However, there are a handful of sectors where AAM’s analysts have a more negative fundamental view than the credit rating agencies. Therefore, we expect that credit and sector selection will be an important driver of performance in 2024.

So, the question remains, are investors getting paid for the risk in the Corporate Bond sector? At AAM we believe the answer is yes, but with a qualified “it depends.” It depends on the maturity and it depends on the sector. Specifically, we’re focused on shorter maturities and we believe that banks have an attractive risk profile with the understanding that it’s critical to be selective. Alternatively, we find technology less attractive given both pricing and rating.

To learn more about AAM’s views on sectors and our outlook for Corporate Bonds in 2024, please refer to the Corporate Credit Outlook.

1 Moody’s; “Annual default study: Corporate default rate will rise in 2023 and peak in early 2024”, Exhibit 29; 4/14/2023. The average annual loss for IG rated debt averages 0% with a maximum loss of 0.3% in 2008 since 1983.

2 Risk of recession for the next 12 months is 45% today vs. 68% in January 2023 per Bloomberg’s United States Recession Probability Forecast. These forecasts are derived from the latest monthly & quarterly surveys conducted by Bloomberg and from forecasts submitted by various banks.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.