insight

Volatility Can Lead to an Attractive Entry Point for Taxable Municipals

May 4, 2022

Download PDFFIRST QUARTER MUNICIPAL BONDS UPDATE

Market Recap

We view volatility and surging interest rates as the major themes driving fixed income performance for the first quarter. Persistently high inflation and geopolitical events exacerbating supply chain bottle necks have helped raise market expectations for a more hawkish monetary policy by the Federal Reserve. Those expectations resulted in Treasury rates moving aggressively higher in 2 and 10yrs by 160 and 83 basis points (bps), respectively1.

Municipal market performance, both tax-exempt and taxable, followed suit and produced one of the worst quarterly performances in the last 40yrs. The return for the Bloomberg IG Tax-exempt Index was -6.23%, while the Bloomberg Taxable Muni Index returned -8.28%1,2.

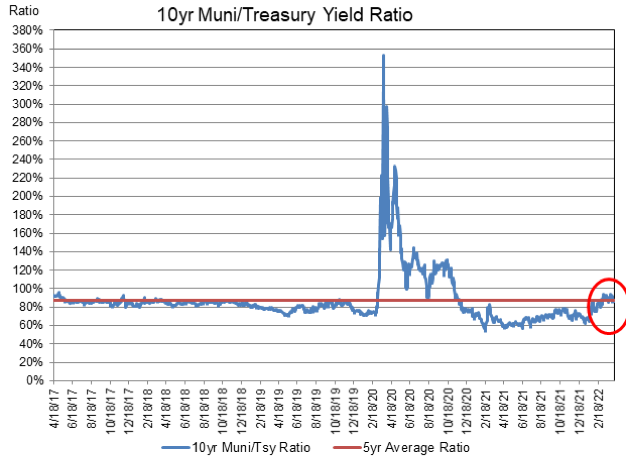

For the tax-exempt market, the negative returns were likely driven by the market correction of what we felt were unsustainably expensive relative valuation levels to start the quarter. At the end of 2021, strong technical forces, driven in large part by heavy reinvestment flows, pressured muni -to-Treasury ratios to 68% versus a 5-year average of 89%1,3. This favorable technical condition would turn dramatically weaker during the quarter as the surge in volatility and interest rate levels led to a massive wave of mutual fund outflows that totaled over $27 billion4. Almost half of those outflows (44%) occurred during March. Tax-exempt yields in 2 and 10yrs moved higher by 152 and 115 bps, respectively. Relative valuation metrics would also move to much weaker levels, with muni-to-Treasury yield ratios finishing the quarter at 93%. On a tax-adjusted basis (21% corporate rate), tax-exempt 10yr yield spread to Treasuries rose by 55bps to end the quarter at 27bps1,3,4.

Taxable municipals did not fare any better than tax-exempts. Historically, this sector tends to follow the performance in corporate spreads. The Bloomberg US Agg Corporate index option adjusted spread (OAS) finished the quarter at 116 bps, moving wider by 24 bps during the quarter. Taxable munis followed in sympathy, with spreads for the Bloomberg Taxable Muni (Agg Eligible) Index OAS increasing by 26bps to end the quarter at 118 bps1,2. What’s notable about this relative performance in OAS between these two sectors is that the muni index OAS finished the quarter at a wider spread of 2bps versus the corporate index, after being as much as 27bps through the corporate index during the first week of March. While corporate spreads were tightening by 26bps between March 8th and quarter end, taxable munis experienced a substantial lag in performance and widened by 3bps over the same time frame1,2.

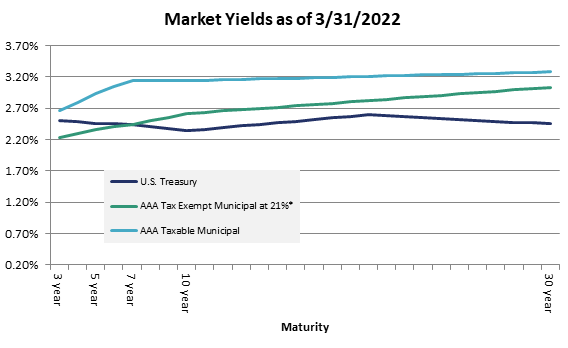

Taxable Municipals are Attractive versus Corporates

In taking a more granular look at taxable muni spread performance, we find that spreads across the curve moved aggressively wider as market volatility pushed many investors to the sidelines and broker/dealers were reluctant to add to inventory levels, in our opinion. Treasury spread levels for ‘AAA’-rated Municipals in 5, 10 and 30yrs moved wider by 33, 45 and 28bps, respectively, to end the quarter at 48, 80 and 83 bps in those same years, respectively. In comparing the yield levels for the muni sector versus yields for the ‘A’-rated corporate industrial sector at quarter end, muni-to-corporate spreads in 5, 10 and 30yrs would widen by 20, 29, and 13bps, respectively. To end the quarter, spread levels to corporates in 5, 10, and 30yrs were at 2, 0 and -22 bps, respectively, versus 5-yr averages in those same years of -16, -18 and -31 bps, respectively. Additionally, ‘AA’- and ‘A’-rated municipal credits provide a range of an additional 10 to 47bps in additional carry versus the ‘AAA’ levels1,2,5.

Outlook: Favorable Technicals Should Support Spread Performance

We view the sector’s relative underperformance and the resultant spread relationships to both Treasuries and corporate as an attractive entry point and we are advocating an increase to the basis. Our target range for building exposure is in the 5- to 30-year range.

Looking forward, we expect spread levels to stabilize and eventually tighten over the balance of 2022. Technicals should provide a favorable backdrop. While market volatility persists, we expect supply conditions will be at more muted levels relative to issuance patterns over the last 2 years. The rise in treasury rates has made it difficult for refinancing economics to work and we’ve already seen this segment of new issuance supply to decline by 48% versus the 1st quarter of 20216. Additionally, in our opinion, underlying fundamentals should remain solid for the sector, buoyed by already applied federal stimulus dollars, and strong revenue performance as the economy continues to grow. However, we remain cautious on credit and we remain very selective, as the more hawkish tone on monetary policy by the Federal Reserve could result in a much slower economic growth environment that could lead to lower revenue projections and budget instability for state and local governments.

Exhibit 1: Tax-Exempt Relative Valuation Levels

Exhibit 2: Taxable Munis: Compelling Alternative to Tax-Exempts

1 Source: Bloomberg

2 Source: Barclays

3 Source: Refinitiv MMD

4 Source: Lipper

5 Source: AAM

6 Source: Bond Buyer

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.