Market summary and outlook

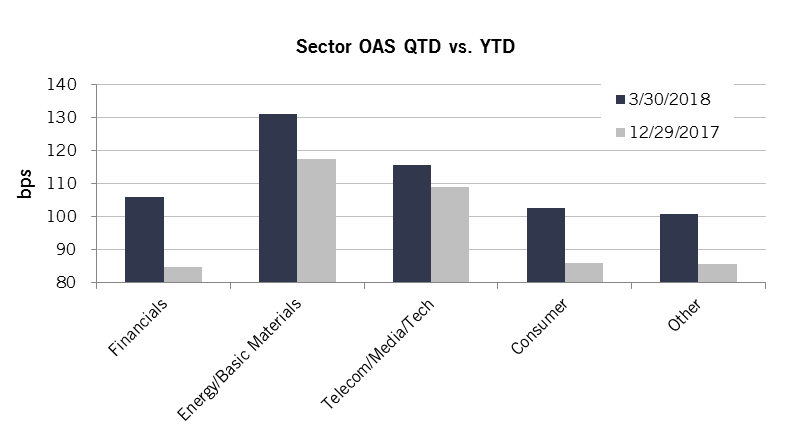

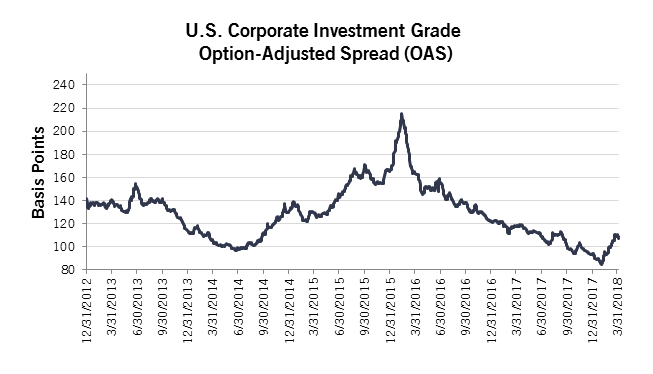

The market has been running at a nice pace for over a year; therefore, recent volatility has felt rather uncomfortable. The Investment Grade (IG) Corporate bond market (per Bloomberg Barclays Index) delivered a lackluster -2.3% total return in the first quarter 2018, due mostly to higher Treasury yields, with spreads widening 16 basis points (bps). Risk assets outperformed the IG market, as the S&P Index returned -0.8% in the first quarter, high yield -0.9%, and Emerging Markets -1.5%. Corporate bonds with longer maturities underperformed. Spread widening was fairly even across credit ratings, leaving ‘BBB’s to outperform ‘A’s due to their yield advantage. Industrials and Utilities outperformed Financials.

Volatility in the markets resulted in less buying from foreign investors and primary market dealers, with corporate bond inventory levels falling to a low last seen in 2015-2016 during the commodity related sell off. Moreover, the rise in LIBOR has increased hedging costs, reducing the attractiveness of US credit for foreign investors. Demand has also waned from fund investors and cash rich corporations post tax reform. Despite new issue supply that is running about 10% below last year’s pace, the reduction in demand was sufficient to push spreads wider especially on the short end of the curve.

Our outlook for 2018 is predicated on fundamental improvement and continued demand for corporate credit. Fundamentals are performing as expected, and our credit cycle indicators remain in check. Revenue and cash flow estimates are being increased, management is forecasting strong capital spending post tax reform, debt leverage is projected to remain stable and should decline as corporate yields increase. Importantly, we do not expect companies to increase debt leverage to repurchase stock. We expect market technicals to improve over the near term with the tightening of supply (lower level of dealer inventories and a projected decrease in net new supply vs. 2017). The risks to our outlook are: (1) slower than expected GDP growth (2) a flattening or inversion of the yield curve (3) reduced demand for IG corporate bonds. Thus far, we have had pressure from risk #3 and some concern in regards to risk #1 given the disappointing economic data in Europe.

Performance summary year-to-date

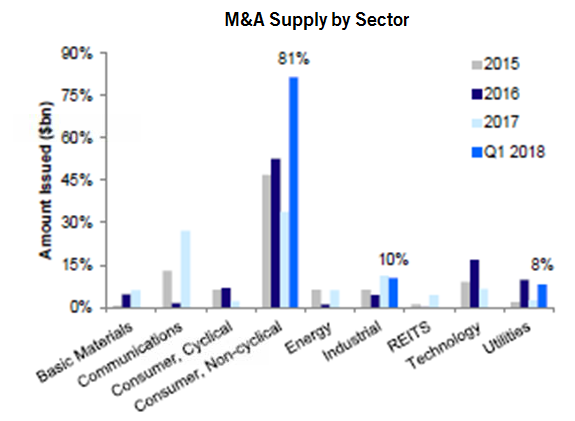

Spreads widened in the first quarter, with OAS 16 bps wider for the market index. The widening related to: (1) spread widening related to new issues or headlines associated with mergers and acquisitions (M&A) in sectors such as Cable, Health Insurance, Consumer Products and Food and Beverage that face secular challenges impacting growth. We have been expecting these companies to look for opportunities to use their underleveraged balance sheets to acquire assets or be acquired; (2) selling and reduced demand for short duration corporate credit given the lack of relative value for corporations and foreign investors given tax reform (i.e., companies no longer need to hold trapped cash overseas) and the increase in LIBOR and affect on hedging costs. That selling impacted sectors like Banks that have more bonds in the short end of the maturity curve. (3) headlines associated with policy changes (i.e., tariffs and trade which affected sectors like Autos, or unexpected changes to FERC regulated pipelines that affected sectors like Midstream). Only two sectors registered positive excess returns versus Treasuries, Packaging and Wirelines. Wirelines outperformed due to creditor friendly actions taken by AT&T.

Source: Bloomberg Barclays Index; AAM (Other – Transportation, Utilities, Capital Goods)

Source: Mizuho Syndicate report 1Q2018

Credit market fundamentals

Indicators monitored by AAM continue to be supportive for corporate credit. Bank lending standards continue to loosen, nonbank creditor data has improved, capital markets (leveraged loans, high yield) remain wide open and attractive to borrowers, and the yield curve remains upward sloping. That said, yields (especially on the front end) are increasing and while higher interest expense is not a burden for an Investment Grade company, we expect higher yields will start to pressure the financial performance of leveraged borrowers (consumers and corporations). Tax related savings and higher revenues due to the expectation for continued strong global growth are expected to offset this cost for the average borrower over the near term.

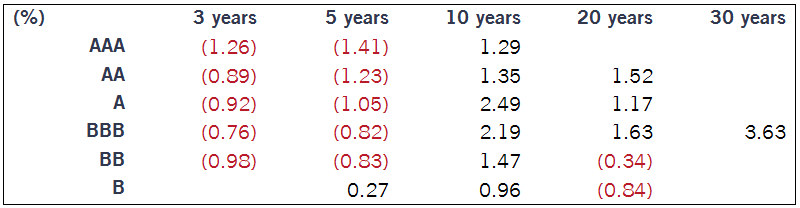

That said, generally in an environment of higher growth and interest rates, companies should not be as apt to increase debt leverage especially to repurchase shares. For the first time since the recession, companies are facing higher yields to refinance maturing debt.

Difference in the Cost of Maturing Debt vs. Refinancing Rates

Source: Bloomberg Intelligence, BVAL

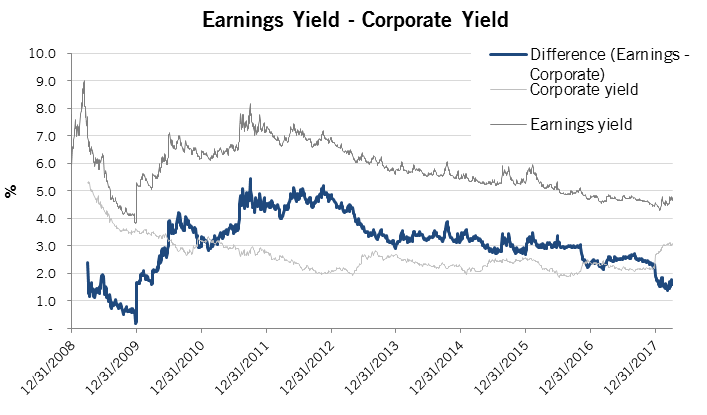

Given the equity market rally, reduced tax rate for corporations, and higher Treasury yields, the economic advantage of raising debt to fund share repurchases is starting to look less attractive. As shown in the exhibit below by the dark blue line, the spread between earnings and after tax borrowing yields is much tighter today. We recognize debt leverage at the corporate level is high, and have written on this topic extensively, but looking forward, we believe companies are more incentivized to reduce debt leverage.

Source: Bloomberg, AAM (Corporate Yields calculated using Bloomberg Barclays Corporate Index OAS plus 10 year Treasury yield multiplied by (1-corporate tax rate); Earnings Yield is for S&P 500)

Market Opportunities

The Corporate market lacked value at the start of the year, thus we have welcomed recent spread widening. With the increased M&A, we are (once again) taking advantage of new issues to fund corporations we believe are better positioned (e.g., General Mills, CVS).

Aside from M&A headlines, trade related headlines have caused extreme equity market volaitiliy, directly affecting sectors like Autos and indirectly affecting the entire market as investors demand higher credit spreads to compensate for it. We are taking advantage of opportunities where we believe the market is being too punitive. One example is the Auto sector where we are more positive than the market on both fundamentals and valuation. Check out our video from the Chicago auto show for more details on the sector’s fundamental outlook. https://aamcompany.com/insight/aam-at-the-chicago-auto-show/

Lastly, to remain largely neutral to the Corporate sector given lackluster valuation, we are funding these ideas with credits in sectors that have outperformed (e.g., Wirelines, Aerospace/Defense). We continue to believe 2018 will be one where security selection drives returns, as the market overall delivers fairly pedestrian performance.

Source: Bloomberg Barclays, AAM as of 4/6/2018

_____________________________________________________________________________________________________________________________________________

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.