THIRD QUARTER CORPORATE CREDIT UPDATE

Market Performance – A Volatile but Unchanged Third Quarter

The Investment Grade (IG) Corporate bond market had a volatile third quarter with the option adjusted spread (OAS) fluctuating in a range of 131-164 bps, while only closing 2 bps wider vs. the second quarter. With this spread movement, the IG market generated an excess return versus a duration-neutral Treasury of -0.3% for the third quarter1. Year-to-date (YTD), when including the underlying Treasuries, the IG market returned -19%2 with Treasuries responsible for 80% of that performance and spread widening the remaining 20%. This compares to the S&P Index which returned -24% YTD, and the High Yield market -15%3.

As we would have expected, the more liquid and cyclical sectors underperformed as did longer maturities4. We estimate the IG market is pricing in a probability of a recession of around 50%. The differential between ‘A-/higher’ and ‘BBB’ rated Industrial sector bonds was largely unchanged at 78 vs. 81 basis points (bps) last quarter. This is slightly higher than its 10-year median of 61 bps5.

Global markets are adjusting to rapidly higher yields, a much stronger U.S. dollar, global economic uncertainty, and a contraction in liquidity. Consequently, the level of uncertainty is very high. This uncertainty coupled with a Fed that relies on backward looking data and trend analysis increases the likelihood that spreads remain volatile. Our expectation is for the OAS to fluctuate between 140 and 200 bps, with 200+ bps more likely to occur if the probability increases for a hard landing and/or an external shock materializes.

In this newsletter, various team members in AAM’s corporate group will explore some of these risks in more detail. Market volatility will persist as long as there is ambiguity related to the magnitude of the downside, such as a soft or hard landing for the economy. In other words, with Halloween in mind, just how large is the “monster” lurking around the corner?

Monster #1 – Europe

A recession in Europe has become increasingly likely in 2023. Bloomberg’s economic model shows the probability at 73%, up from 20% at the start of 2022. This compares to a 28% probability for the U.S. The IMF’s chief economist said in an interview with the Financial Times that 2023 would be the “darkest hour” for the global economy, cutting its global GDP growth forecast for 2023 to 2.3% from 3.6%6.

Sky rocketing energy prices and affordability challenges have prompted European governments to unveil plans to counter stress, but this has come with renewed scrutiny on public finances and policy making in the region, which in turn has led to volatility in sovereign bond yields. European banks, a large portion of the European corporate bond market, stand to benefit from support measures aimed at supporting households and businesses but remain vulnerable to volatile yields as large purchasers of sovereign bonds. Additionally, as many European banks continue to restructure their businesses, elevated market volatility may weigh on execution and weaken confidence among investors.

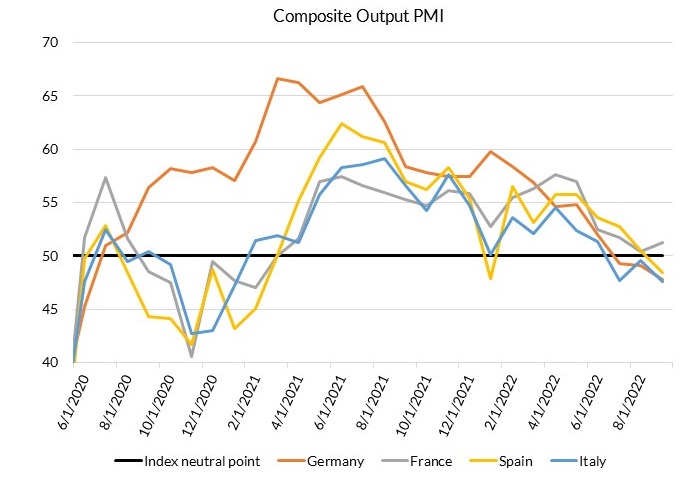

The energy crisis in Europe continues to be an issue, particularly in Germany. In response to high natural gas and electricity prices as well as to conserve natural gas for home heating needs this winter, industrial users in Europe have curtailed natural gas consumption by 28% year over year7. This has led to contracting PMIs in Spain, Italy and especially Germany (see Figure 1). While natural gas prices have declined in recent weeks to reflect adequate inventories currently, we believe the recent incident with the Nord Stream 1 pipeline will result in much higher than normal natural gas and electricity prices through 2023 at least. That should lead to ongoing high energy costs, weaker industrial activity and increased unemployment.

Monster #2 – Liquidity

Liquidity was challenging in the third quarter, and we expect that to continue for the rest of 2022. Quantitative Tightening (QT) ramped in September, and bank reserves have fallen. We await bank earnings commentary and the results from the Senior Loan Officer survey, while anticipating that tightening lending standards continue. Positively, we have seen the largest banks manage down G-SIB scores earlier than prior years, decreasing the risk of a seize in liquidity towards year-end.

Markets continue to be plagued with changing supply and demand dynamics, with many largely closed this year. The U.S. mortgage backed security (MBS) market was one example, coming under pressure in September as fears resurfaced about the Federal Reserve selling mortgages. Demand has fallen for new issues as well. While the high yield market has been largely closed to the average issuer in 2022, the IG market had been very active until later in the third quarter when it slowed as well. Finally, after a record-breaking year in 2021 at 906, only a little over 100 U.S. IPOs have been completed this year8.

Regarding liquidity at the consumer level, the growth in M2 has fallen below 5%. Historically, when that occurs, GDP growth falls over the next 12-24 months9. Also concerning is the anticipated drop in home values, which has been a source of liquidity for many consumers via mortgage refinancing.

Exhibit 1: European PMIs are Contracting

Monster #3 – Default Risk

The permanent financing for the Citrix LBO resulted in a hefty loss for the banks that underwrote the debt, as investors repriced risk since the deal was announced in January of this year. Around 12% or over 100 issuers in the high yield market have bonds trading at distressed levels (>1000 bps), and around 15% of the Russell 2000 Index have equity values that have fallen more than 60%, two-thirds of which have negative free cash flow10. According to a Moody’s study, a 300-basis point rate increase would cause nearly half of the North American rated B3-rated companies’ interest coverage ratio (EBITDA minus capex and interest) to fall below 1x. While hedges and LIBOR floors would partially mitigate the risk for some, Moody’s believes “very few B3 rated companies will be immune to the rising interest rate environment.”11

The access to liquidity at very low cost has enabled many companies to survive and thrive in a structurally lower growth environment. We have a real concern about the ability for weakly positioned, leveraged companies to survive in a new regime and expect defaults and/or restructurings to increase at the start of 2023. We have greater concerns about these issues in the shadow banking sector given the relatively strong capital positions of banks post Dodd-Frank.

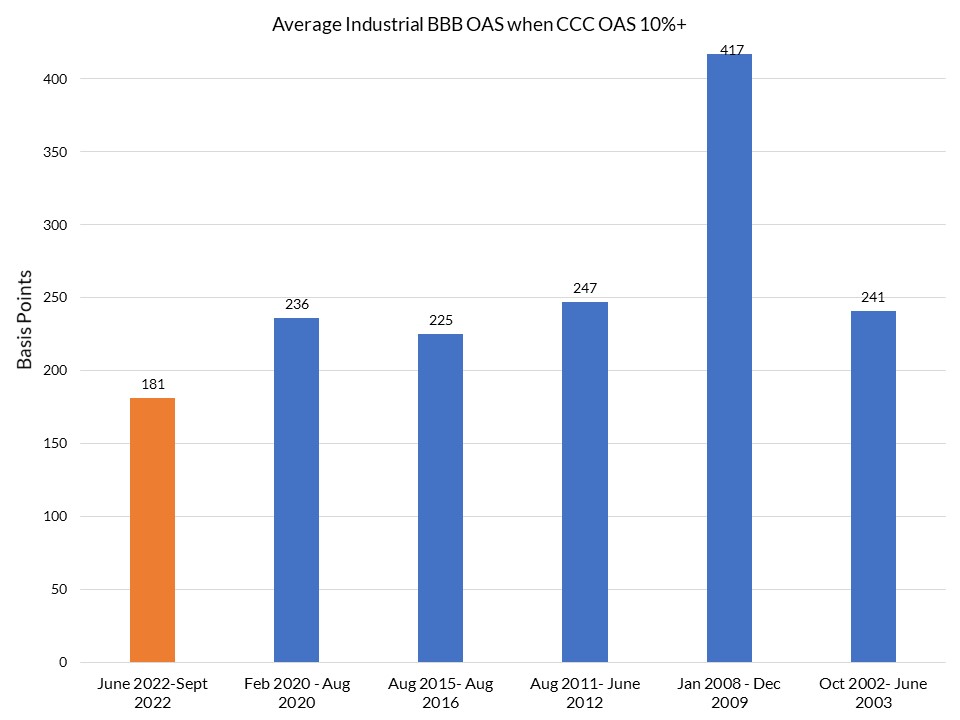

Moody’s current default forecast is benign with defaults peaking at 3.8% in August 2023, assuming a 4.1% unemployment rate12. However, Moody’s pessimistic scenarios include default rates of 7% and 11% with unemployment exceeding 7%. In this environment, it predicts a high yield spread of around 700-800 bps13. We believe that would reprice the IG OAS materially wider to over 220 bps. As shown in Figure 2 below, BBBs are trading inside their historic averages today, which is likely due to the more benign default forecast.

Exhibit 2: BBB Spreads are Inside Their Historic Averages

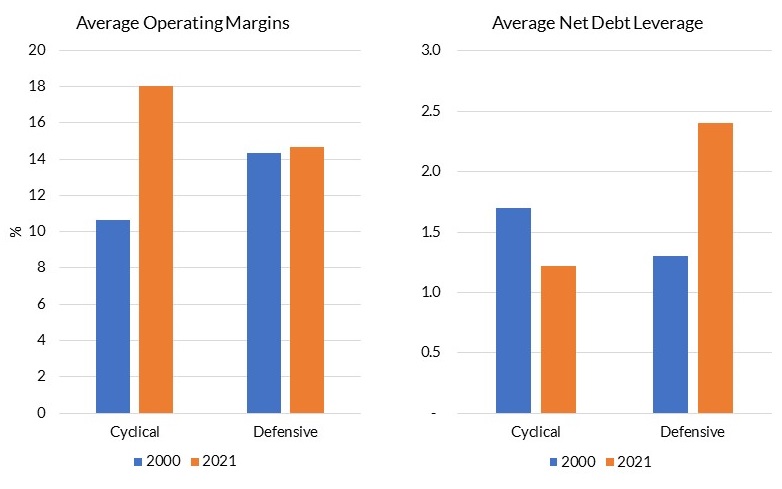

While IG fundamentals are entering this period in a good position as evidenced by higher margins and lower debt leverage for economically sensitive sectors (“Cyclical”; Figure 3), IG spreads should adjust to rising risk premiums in weaker markets; therefore, IG will not be immune.

Exhibit 3: Margins Have Expanded and Debt Leverage Has Fallen for Economically Sensitive Sectors

Monster #4 – Inflation

While some may debate whether the U.S. economy is heading for a recession, a glance across commodities makes it appear as though one has already started. Commodities such as lumber, copper, iron ore and aluminum have all experienced significant corrections and are trading close to pre-pandemic highs. The exception to this general weakness has been agriculture related commodities and fertilizers, which remain elevated due to high natural gas prices, the war in Ukraine and poor weather in the U.S. We have also seen commodity chemical producers pre-announce negative earnings surprises ahead of third quarter releases. The companies cited ongoing disruptions in China and Europe but also softening demand, particularly in construction and consumer durables. Two widely used petrochemical products, polyethylene and polypropylene, have experienced corrections similar to the commodities previously mentioned.

Commodity prices are volatile and tend to react more quickly to a weakening economy relative to other stickier prices such as wages and rents. It is probably not wise to base policy solely on what is happening with commodities. That said, it would be wise to at least heed the warning signs that are clearly flashing from certain commodities. In the meantime, we expect the Fed to patiently wait until their inflation measures are no longer concerning and that may take time given lagging indicators.

Market Outlook – More Ghouls in the 4th Quarter

We expect volatility to persist in the fourth quarter. Despite seeing signs that inflation should taper, growth remains healthy and late stage inflation drivers will likely remain problematic. Therefore, we do not expect the Federal Reserve to pivot in the near term notwithstanding a material market event. The longer rates remain elevated and growth low, the higher the probability of a hard landing for the economy not just domestically but globally. Our recommended positioning remains defensive.

1 Bloomberg Barclays Corporate Index

2 Bloomberg Barclays Corporate Index

3 Bloomberg Barclays High Yield Index

4 Bloomberg Barclays Corporate Index

5 Bloomberg Barclays Corporate Index

6 “IMF forecasts ‘very painful’ outlook for global economy,” Financial Times, 10/11/2022

7 Morgan Stanley

8 Bloomberg

9 Bloomberg

10 Bloomberg

11 Moody’s “As rates rise, interest expense could become untenable for half of B3 companies” 06/2022

12 Moody’s “August 2022 Default Report” 9/19/22

13 Moody’s “August 2022 Default Report” 9/19/22

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.