Market Summary and Outlook

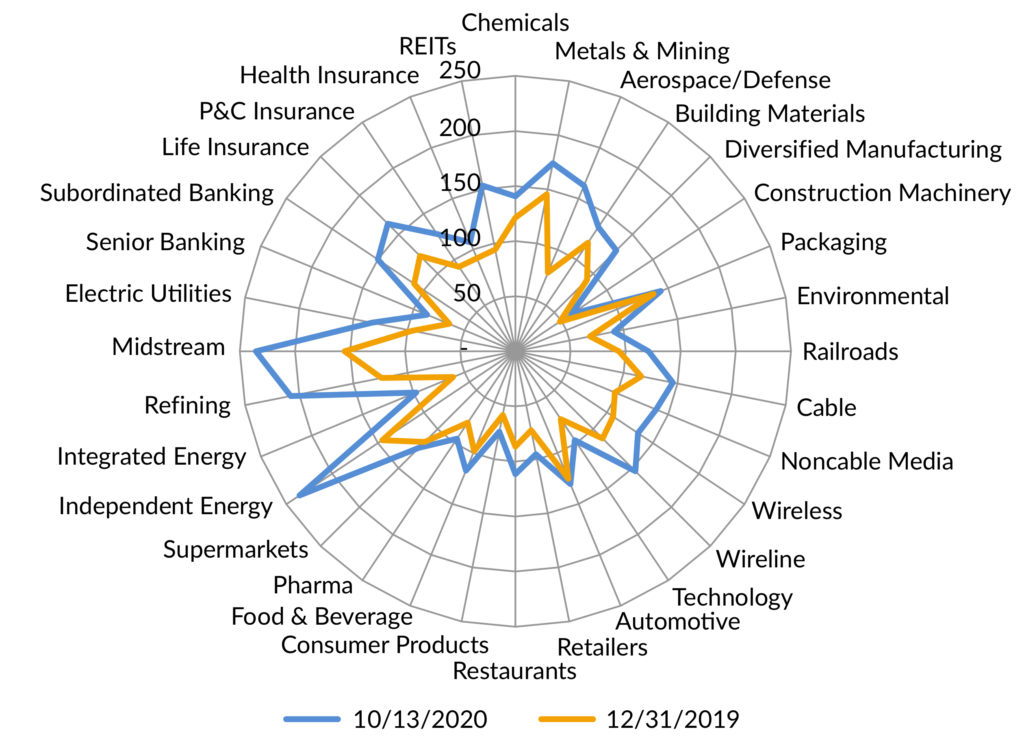

The Investment Grade (IG) Corporate bond market (per Bloomberg Barclays Index) generated modest returns in the third quarter of 2020, with an excess return versus a duration neutral Treasury of 1.1%. The IG market underperformed the S&P Index, which returned 8.4% and High Yield market (per Bloomberg Barclays) at 4.0%. The option adjusted spread (OAS) of the market tightened 17 bps in the third quarter, with cyclical sectors and BBBs generally outperforming.

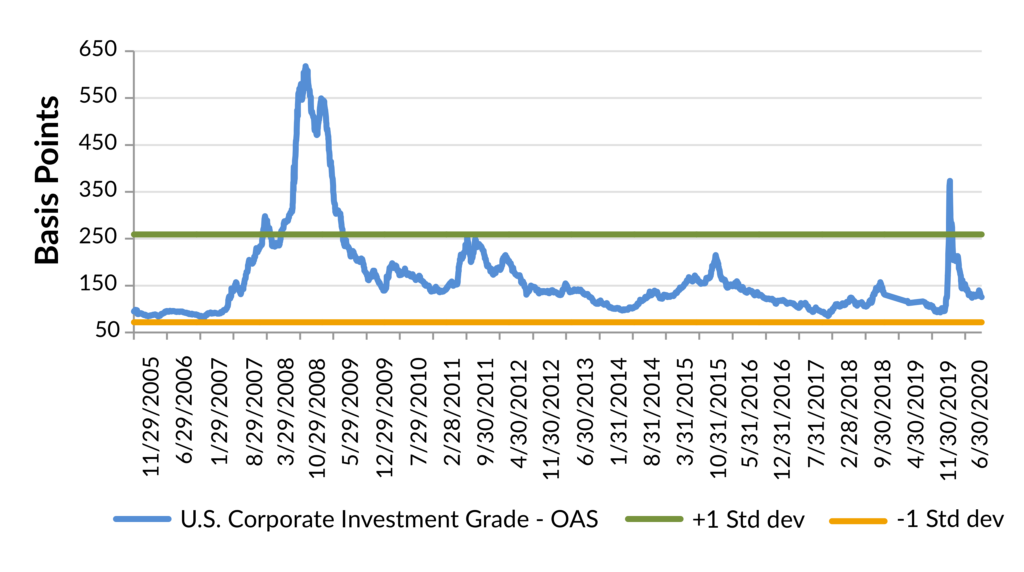

Exhibit 1: Corporate IG OAS – Quick Recovery and Return to Neutral

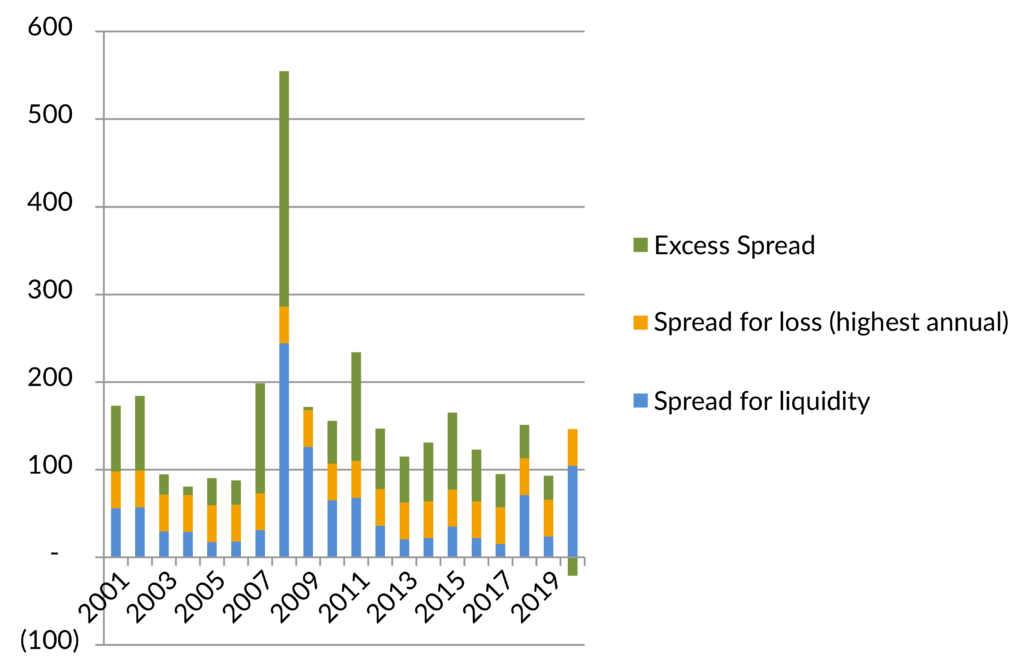

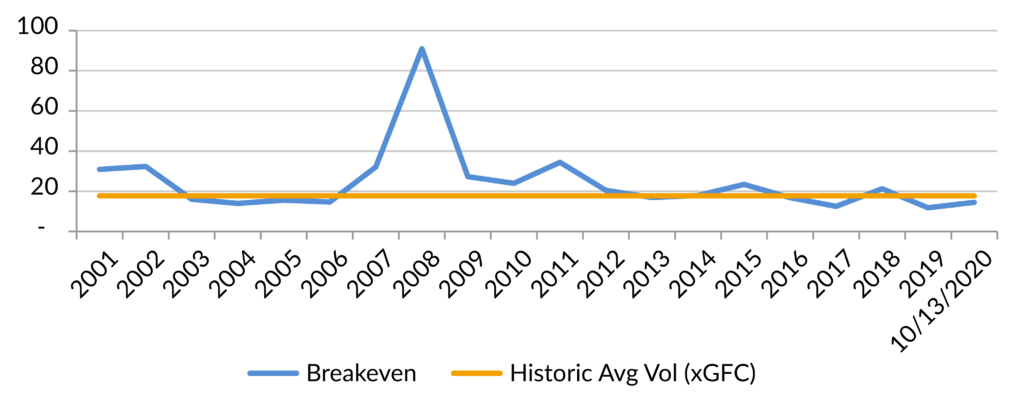

We continue to expect a widely available vaccine in the middle of 2021, with a treatment likely before that time and federal legislation providing additional fiscal stimulus becoming law in early 2021. The Federal Reserve is expected to remain accommodative for some time. Accordingly, we believe a recovery is on the horizon, which is supportive for risk assets. After raising a record level of cash, we believe IG companies have sufficient liquidity to weather a protracted recovery. And, it’s highly likely that the Federal Reserve has ample room in its primary and secondary market facilities to support the IG corporate market if market liquidity worsens. In this environment, IG corporate bond spreads should trade in a relatively narrow range, implying a lower level of volatility versus other risk assets, limiting downside risk from a trading/technical perspective. That said, our analysis shows that the average spread of the market is reflecting little to no spread for volatility (Exhibits 2 and 3). This simply causes us to dig deeper to find value in the market. We have done that in sectors that have underperformed and more illiquid parts of the market, as that premium has increased.

Exhibit 2: Composition of IG OAS – An Increased Liquidity Premium Leaves No Room for Volatility

Exhibit 3: OAS Breakeven vs. Volatility – OAS Lacks Compensation for Historic Level of Volatility

From a fundamental perspective, credit metrics are expected to remain stressed over the next six months. While second quarter may be the bottom for earnings, we expect last twelve month leverage ratios to continue to deteriorate, as the improvement in EBITDA should be gradual over the next 6-12 months. Our estimate is for EBITDA to return to pre-COVID 19 levels sometime in 2022, as the Capital Goods, Leisure, and Commodities sectors take some time to recover. Importantly, while the rating agencies have been patient over the last few months, we believe they will begin to take action if the recovery disappoints. Approximately $200 billion of the $6 trillion in Corporate bonds in the IG Index have spreads that reflect high yield ratings (AAM Analysis of Bloomberg Barclays Index), of which about half we believe are at risk of falling to HY. To date this year, over $200 billion has fallen out of the IG index (Bloomberg Barclays Index). In summary, we believe the market is pricing downgrade risk fairly rationally today.

As spreads have tightened, we have been selling bonds with unattractive spreads and buying those that provide attractive compensation for liquidity and/or industry risk premiums that we calculate in the near to intermediate term. For example, we have sold bonds in sectors that have been more immune or benefitted in this environment such as Pharmaceuticals, Food and Beverage, Senior Banks and Technology. We have also reduced our exposure to the Healthcare sector given upcoming political risk related to the increasing probability of a Blue Sweep. Conversely, we have added to sectors that we believe offer attractive risk adjusted income opportunities (i.e., Midstream, Refining, Insurance and REITs) as well as adding Private Placements, a market which has become more attractive due to the increased liquidity premiums.

Exhibit 4: Sector OAS Comparison – BBBs and Cyclical Sectors have Wider Spreads Today

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.