By Mike Ashley

Senior Analyst, Corporate Credit

My fifteen year old son is only a month away from getting his driver’s license. This event has sparked some pretty interesting discussions in the Ashley house. The other day, my ten year old daughter, who is in better touch with the world than her two older brothers, asked me if I thought she would ever need to get a driver’s license when she was older. Knowing I only had her attention for about twenty seconds and wanting to be as honest as possible I simply said, “I don’t know.”

Saying that the auto industry is going through dramatic changes is an understatement. Ford just promoted its previous head of Ford Smart Mobility to President & CEO. Tesla, a company founded just thirteen years ago with no dealer network and no advertising, recently surpassed both Ford and GM in terms of market capitalization. The purpose of this report is to explore the trends in the auto industry and to discuss AAM’s thoughts on expected auto sales.

AUTO SALES – Past, Present, & Future

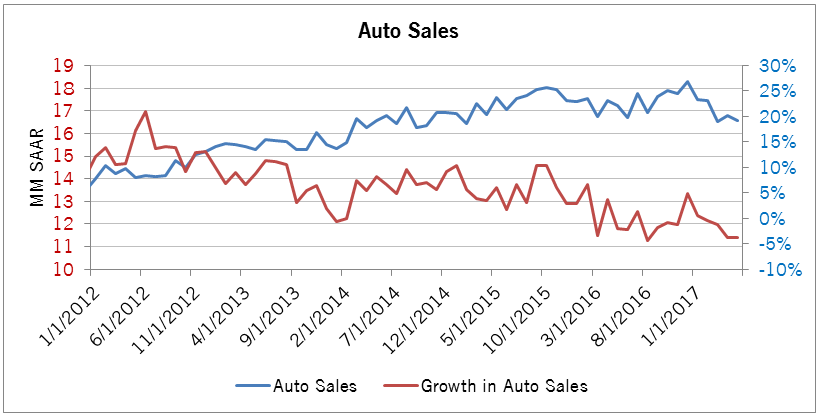

As we forecasted in our 2017 Corporate Market Outlook, auto sales have been weaker than expected. Each month, it becomes clearer that we are near the peak of auto sales in the U.S. In fact, we may have already passed that point. The chart below compares monthly auto sales (blue line) with year-over-year growth (red line). We have seen a slowing trend in growth since 2012 and now have experienced negative growth in ten of the last twelve months. Some of the reasons for this include slowing incentives, lower trade in values (falling used car prices), and more conservative underwriting within auto lending, especially in sub-prime. Most major auto manufacturers agree that lower sales at better/similar margins is a better alternative to higher sales at lower margins. This most likely translates into lower production and then stagnating new auto sales.

Combine slowing sales with huge advancements in technology, new competitive threats, and evolving consumer behavior and you get a very unpredictable and exciting industry outlook. While we wouldn’t expect the size of the pie (market) to be that much different, we would expect the number of slices (competitors) and layers (customers) to change significantly. Our base assumption is for U.S. auto sales to tail off for the next three years, ending the decade at around the mid-15 million Seasonally Adjusted Annual Rate (SAAR). For 2017, we expect sales will come in around 17 million.

While the average consumer is in good shape, we don’t expect the industry to continue to benefit from strong used car prices and attractive financing. We believe these tailwinds have been partly responsible for annual sales exceeding analyst expectations over the past several years. Going forward, the industry expects a record number of leased cars to come due which should help to push used car prices down, and we would generally expect lending conditions to tighten as subprime performance deteriorates. Beyond 2020, forecasting auto sales could prove very difficult given three potentially game-changing developments.

#1 Autonomous Vehicles

There are different levels of self-driving cars, also known as autonomous vehicles. Currently, there are no vehicles on the road in the U.S. that require zero human input (known in the industry as “Level 5”). But beware – this is coming and it is coming soon. The second generation Tesla Model S and Model X have the necessary equipment to drive completely on their own but have not yet been enabled. For Tesla, the goal of full autonomy is an evolving process which involves slowly rolling out self driving features and testing them against real life data as miles driven by these cars pile up by the millions.

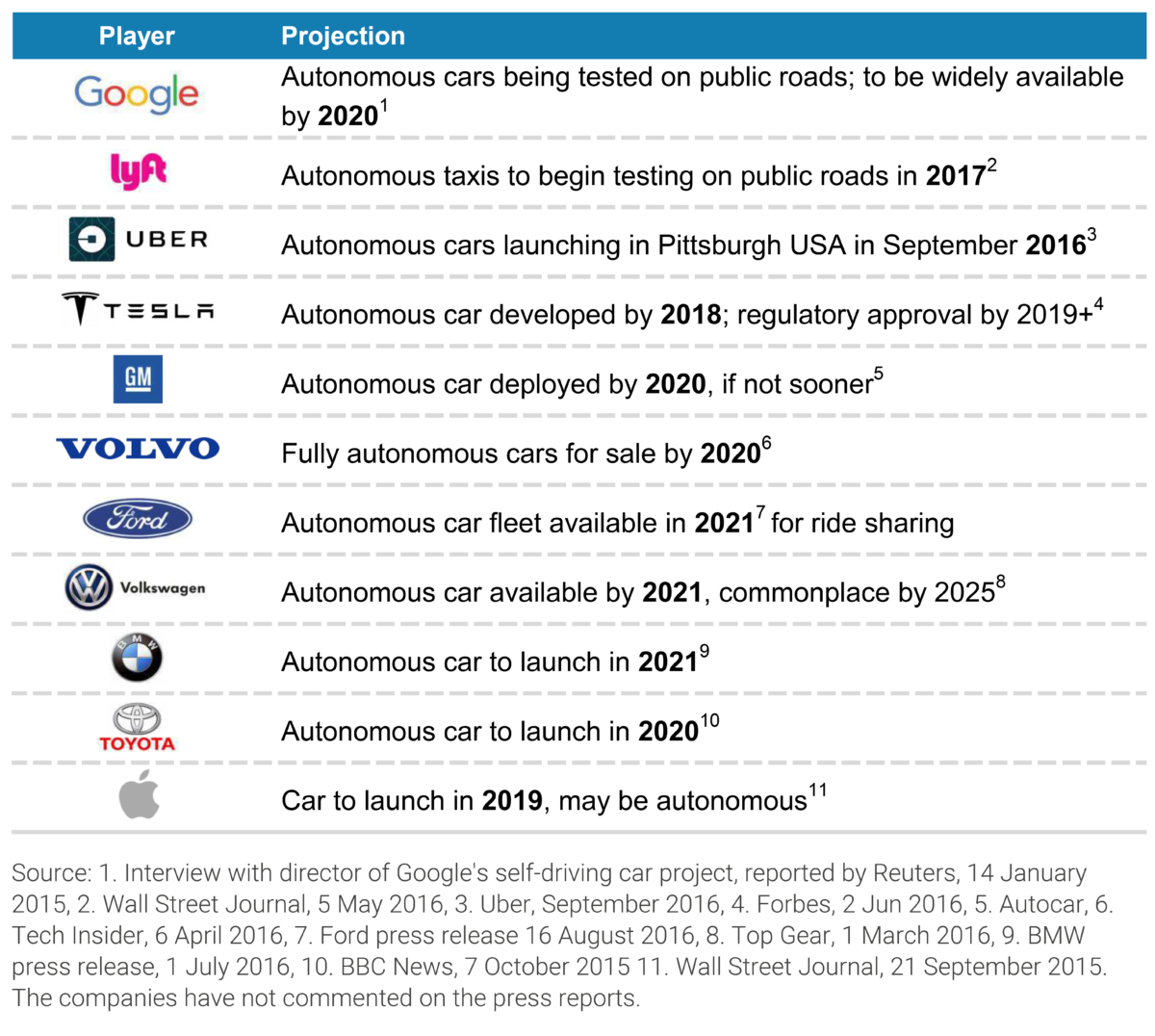

Ideally, a world with autonomous vehicles would mean less accidents and traffic, lower economic costs, more efficient energy/fuel consumption, and increased mobility for children and the elderly. Most automakers have picked up on the trend and are heavily investing in it, although it is still up for debate as far as which companies will excel in this area. In any case, we would expect a significant number of fully autonomous vehicles on the road from multiple manufacturers in the next five years. However, regulatory issues could cause a major roadblock which could delay the process, especially for higher level automation. It should also be noted that this technological advancement touches several other industries including bars & restaurants (about one third of traffic fatalities are alcohol related) and providers of auto insurance (fewer accidents and injuries). The following graphic, put together by Morgan Stanley, is a nice overview of key participants in the area of autonomous driving.

#2 Electric Vehicles

Morgan Stanley believes that by the year 2040 electric vehicles will account for 51% of global sales and will comprise 24% of the global passenger car fleet (Morgan Stanley, p.4, May 5 2017, One Billion BEVs by 2050?). Volvo recently announced that by 2019, every car it produces will have an electric engine. This trend away from gas powered engines started with Toyota’s Prius introduction in 1997, the first mass produced hybrid vehicle, although less than 5% of vehicles sold today in the U.S. fall into the hybrid/electric category. Electric cars started to gain more consumer acceptance with the introduction of vehicles by Tesla which were mostly geared towards high income consumers. This category is expected to grow quickly as the total cost of ownership gets closer to similar gas combustion engine vehicles. In addition, consumers’ concerns regarding limited range, access to plug-in stations, and battery life are becoming less pressing as the appropriate infrastructure is being built and battery technology improves. Currently, there are several concepts being kicked around regarding the future of electric vehicle charging. These ideas include solar roof charging, autonomous “park & charge” facilities, and wireless road charging as conceptualized in the picture below.

Other inputs relevant to the demand for electric vehicles include the continuation of government subsidies and the cost of gasoline. If Morgan Stanley is correct with its estimates, we would expect a number of industries to be significantly impacted. For example, there is six times the amount of semiconductor content in an electric vehicle versus a gas powered vehicle (UBS, p.76, May 18 2017, UBS Evidence Lab Electric Car Teardown- Disruption Ahead?). Companies such as Infineon, Intel and Texas Instruments are already treating this area as a significant source of growth with capital already invested.

#3 Car Sharing

On Zipcar’s website one of its slogans reads, “The genius of car sharing…it’s like owning a car, without the sucky parts.” Car sharing has gained popularity in urban environments where public transportation, biking, and walking are often the primary ways to get around. Cars can be rented by the hour versus on a daily basis. Members are not responsible for any maintenance and insurance and gas are included in the price. The process is very convenient, and cars come in a wide variety of shapes and sizes.

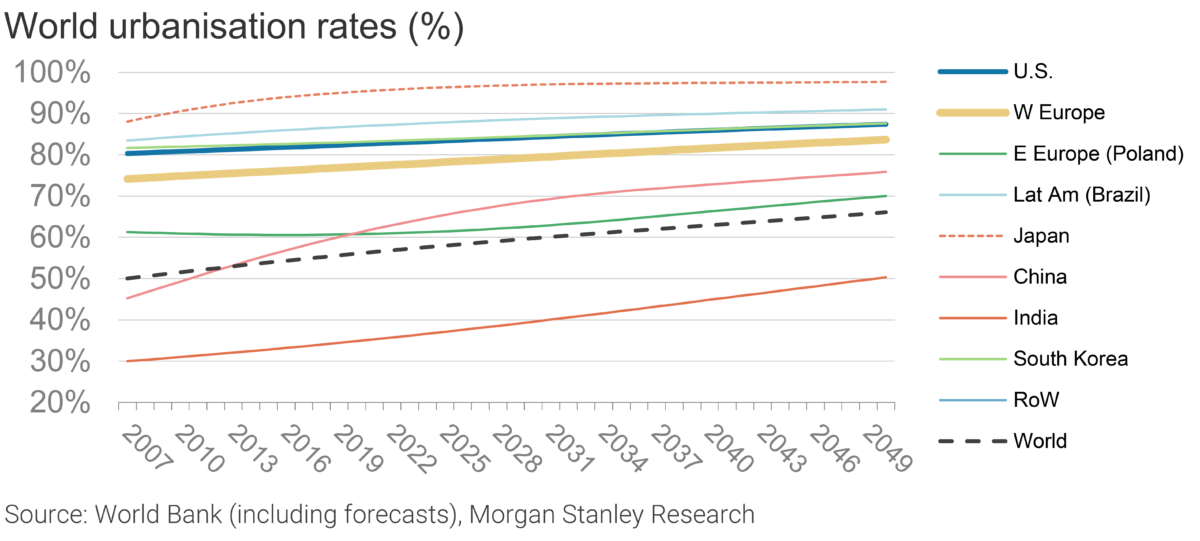

Car sharing companies are typically owned by either major rental car providers (i.e., Avis owns Zipcar) or by auto manufacturers (e.g., GM started Maven). We would not expect car sharing to be used by drivers who use their cars on a daily basis, such as those who commute to work, but at the end of the day, we believe car sharing should theoretically limit the growth of auto sales. This trend seems to be more of a reshuffling of sales for the rental car industry than anything else. Outside of the U.S., in those countries with a higher rate of urbanization and population growth, car sharing could result in additional auto sales growth. The exhibit below shows the differences in urbanization rates between developed countries such as the U.S. and Japan versus emerging countries, like China and India.

Auto Trends Not Expected to Enhance Sales Growth

We expect the coming years in the auto industry to be extremely exciting for consumers and highly challenging for manufacturers. Competition has never been more intense as the race to incorporate new technology and consumer trends has piqued the interest of non traditional auto makers with excesses of cash. However, even with this excitement, we don’t expect these trends to support higher auto sales on their own. We forsee more of a transition and replacement type of cycle where older gas combustion cars are phased out, and longer term, we expect auto sales to follow demographic trends and economic growth.

To put it simply, the companies with the most resources are expected to do the best. So far, Tesla has benefited from its “first mover” strategy and impressive execution led by the visionary leadership of Elon Musk. Others have followed by either developing the product on their own or using technology from existing products. Earlier this year, BMW, Mobileye, and Intel announced a collaboration that would result in autonomous vehicles by 2022. Later in March, Intel announced the purchase of Mobileye for $15.3 billion. Daimler is probably the most aggressive among the global automakers with at least €10 billion expected to be spent on electric mobility alone. Recently, Daimler announced an agreement to supply Uber with self driving vehicles. We expect these examples of collaboration, partnerships, and acquisitons to continue on a large scale. The race to develop a high tech, fully autonomous, eco friendy vehicle is on!

Written by:

Mike Ashley

Michael J. Ashley is a Principal and Corporate Credit Senior Analyst at AAM with 19 years of investment experience. Prior to joining AAM, Mike worked at Northern Trust Global Investments with responsibility for following investment grade industrials including credits in the basics, energy, consumer products, media, and retail sectors. Mike earned a BA from the University of Iowa in Management Information Systems and an MBA from DePaul University in Finance.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.